BIR Removes Photocopies of Credit Restructuring and Extension Documents as Required Attachments in Submitting Summary Listing of Pre-existing Loans

The Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular (RMC) No. 72-2020 amending the Part C of RMC 36-2020 relative to mandatory photocopies of documents involving credit extensions and credit restructuring as requirements for Documentary Stamp Tax (DST) exemption. This memorandum clarifies the revision of requirements to be attached upon submission of summary listing of pre-existing loans, pledges, and other instruments with the granted extension of payment and/or maturity periods.

REPORTORIAL REQUIREMENTS

The following covered institutions, including but not limited to, shall submit a summary listing in both soft and hard copies:

- Banks

- Quasi-banks

- Financing Companies

- Lending Companies

- Financial Institutions

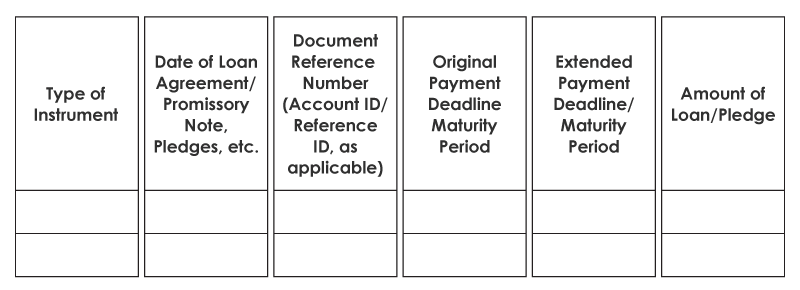

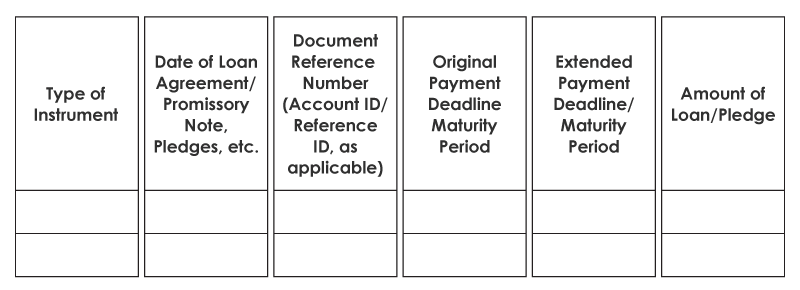

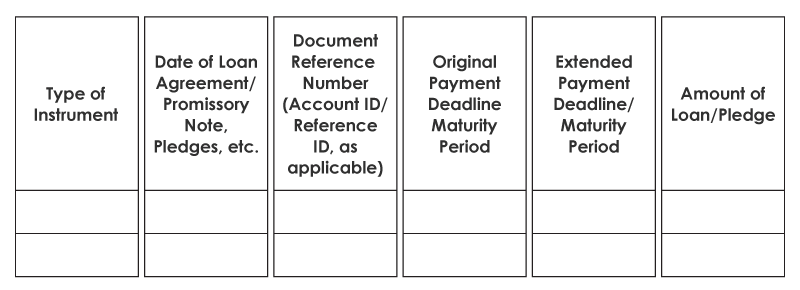

FORMAT OF SUMMARY LISTING

The hard copy of the summary listing shall be made under oath by a duly-authorized officer or representative, and subject to verification if the summary listing tackles only the qualified loans.