5 Tips on How to Effectively Manage Accounting For Your E-Commerce Business

The Securities and Exchange Commission (SEC) issued SEC Memorandum Circular (MC) No. 3-2021 to prescribe the use of the Online Submission Tool (OST) for the filing of audited financial statements (AFS), general information sheets (GIS), and other annual reports of registered corporations in the Philippines.

What Reports Must Be Filed Through OST?

The following annual reports are required to be filed through OST:

- Audited Financial Statements (AFS)

- Duly stamped received by the Bureau of Internal Revenue (BIR) of proof of filing with the BIR should be attached to the AFS

- Duly signed by the auditor and all required signatories

- Compliant with all the AFS requirements as stated in the checklist available on the SEC website

- Sworn Statement for Foundation (SSF)

- General Form for Financial Statement (GFFS)

- Special Form for Financial Statement (SFFS)

- General Information Sheet (GIS)

- Affidavit of Non-Operation (ANO), to be filed together with the GIS/FS (filer may submit a GIS/FS without any movement/change)

- Affidavit of Non-Holding of Annual Meeting (ANHAM), to be filed together with the GIS (also, the filer may submit a GIS, without any movement/change [no meeting held])

Note: Filing is optional for both the ANO and ANHAM, and is considered as an option provided to the public. However, should the filer choose to submit the ANO and ANHAM, these are deemed not filed without being attached to the GIS/FS and GIS, respectively.

Can I Still Submit Hard Copies of Annual Reports to SEC?

No, hard copies of the SEC reports enumerated above SHALL NO LONGER BE ACCEPTED. In addition, submission through email, mail, courier, and chutebox is no longer allowed.

Is it Mandatory to Enrol in the OST?

-Yes, all corporations and partnerships registered with SEC are mandated to enroll in OST and submit annual reports through the system starting March 15, 2021.

What are the Steps for Enrollment to OST?

The steps for enrollment to OST are as follows:

Step 1: Fill out the application form online

Step 2: Attach the following documents:

- Board Resolution from the corporation/partnership authorizing the Company’s representative to file reports on behalf of the corporation/partnership

- Special Power of Attorney (SPA) from the authorized filer/representative of the corporation to file reports (AFS/GIS) for and on behalf of the corporation/partnership

- MC28 Report and/or General Information Sheet (GIS) version 2020 submitted to the SEC

Step 3: Upload the application form, together with the aforementioned attachments

Step 4: Wait for the approval of the application through email and access key (user ID and password) to file reports through the OST

Step 5: If the application is pending approval, wait for a notification through the registered email for compliance with additional requirements, if any

Step 6: The enrollment is a one-time process for the company. In the event the corporation/partnership decides to change their authorized filer, the company shall enroll a new filer and replace the old one, in the same enrollment form provided for the company under the OST

Step 7: The issued access key (user ID and password) shall be used by the filer to access the OST and file the reports

Deadline for Submission of Annual Reports Through OST

All corporations shall submit their GIS within thirty (30) days after their Annual Meeting.

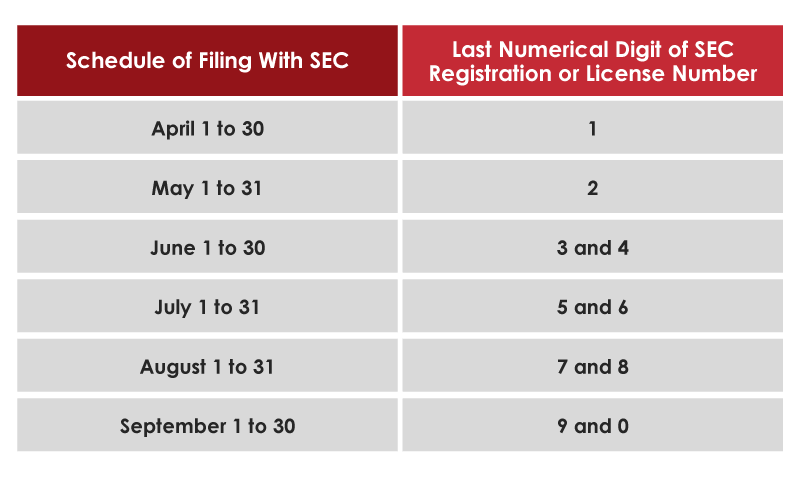

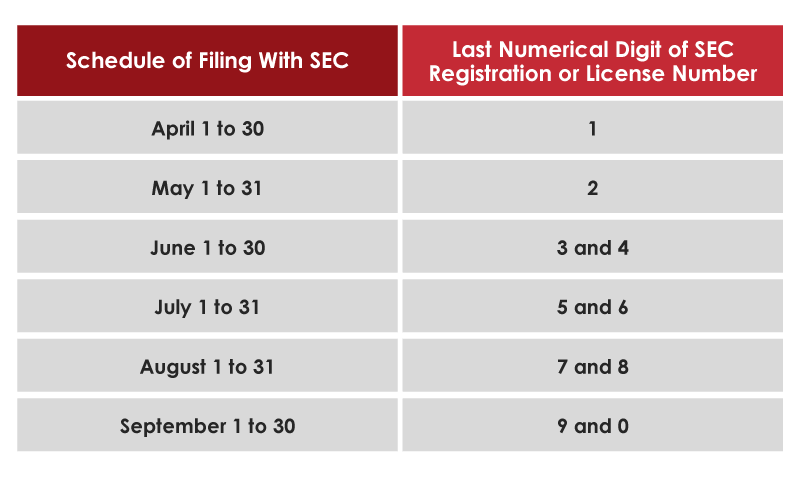

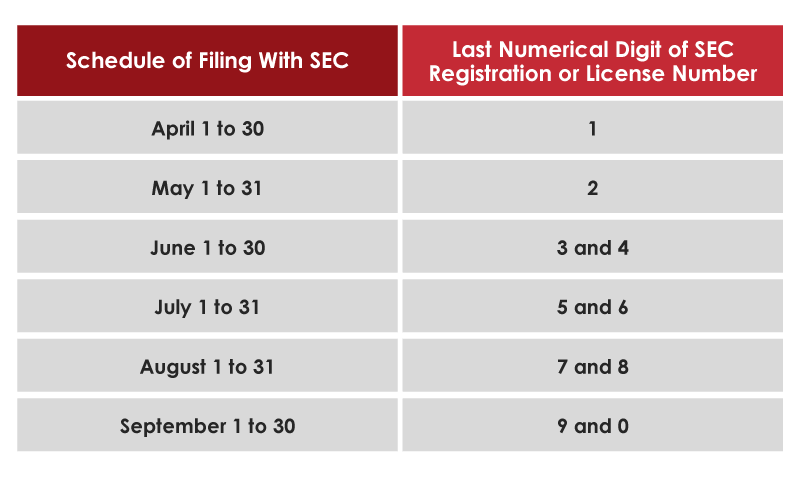

All stock corporations, including branch offices, representative offices, regional headquarters, and regional operating headquarters of foreign corporations, shall enroll and file their AFS through OST depending on the last numerical digit of their SEC registration or license number, in accordance with the following schedule:

All stock corporations may enroll and submit their reports through OST even prior to their respective filing schedule.

For stock corporations unable to enroll and file their AFS through OST based on the above schedule, filing of reports over-the-counter SHALL NOT BE ACCEPTED. Such corporations are mandated to still enroll and file through OST.

Want to know more about the new list of requirements for submitting your annual reports in the Philippines? Visit this link to access the official copy of the issuance.

If this corporate advisory is not applicable to you, please disregard this email.