A Complete Guide of Year-End Tax Compliance for Corporations in the Philippines

Every end of the year, organizations must file and submit their tax compliance requirements to the Bureau of Internal Revenue (BIR) to ensure their business is allowed to operate the next year.

What to Submit During the Year-End Tax Compliance in the Philippines

It is imperative for entrepreneurs and accountants to be aware of such compliance requirements as the process can be exhaustive. To help you prepare, we provide a checklist of the necessary documents you need to secure to comply with the year-end tax compliance in the Philippines.

#1: Submission of Books of Accounts

There are three books of accounts you can register with the BIR, which could depend on factors such as company size and financial capacity. Depending on your company’s registered books of account, your annual compliance to be submitted to BIR is as follows:

- Manual Books of Accounts. Under Revenue Memorandum Circular (RMC) No. 82-2008, taxpayers maintaining manual books of account must register new books when the pages of the previously registered books have already been exhausted. Although manual books are not required to be submitted annually, the BIR may need you to present them upon audit or tax mapping.

- Loose-Leaf Books of Accounts. Businesses maintaining loose-leaf books must submit the bounded books of accounts for the taxable year on or before January 15 from the close of the calendar year or 15 days from the close of each fiscal year. An affidavit must also be submitted confirming the type of books, number of pages, and volume number of books submitted.

- Computerized Books of Accounts. Taxpayers must submit their computerized books in CD-R, DVD-R, or other optical media for the taxable year on or before January 30 from the close of the calendar year or 30 days from the close of each fiscal year.

Sorting out your books of accounts in advance can help ensure that you will not encounter any tax-related problems during the year-end tax compliance.

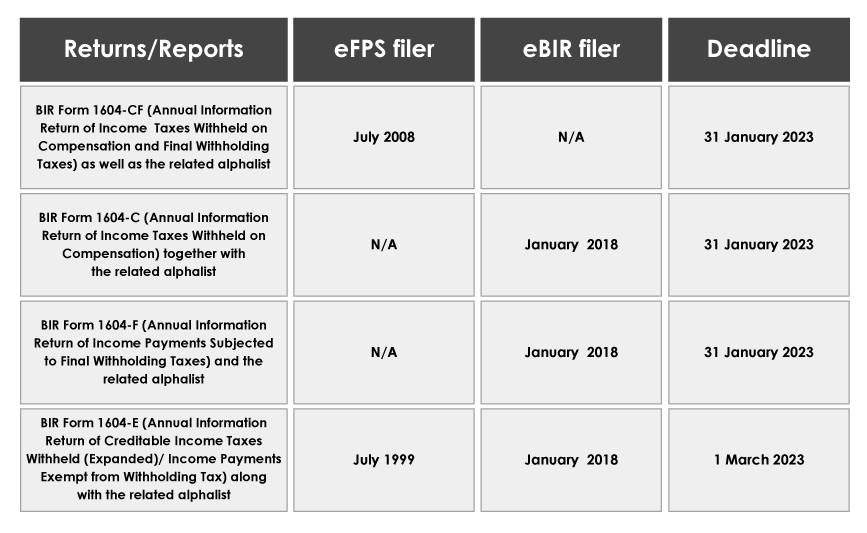

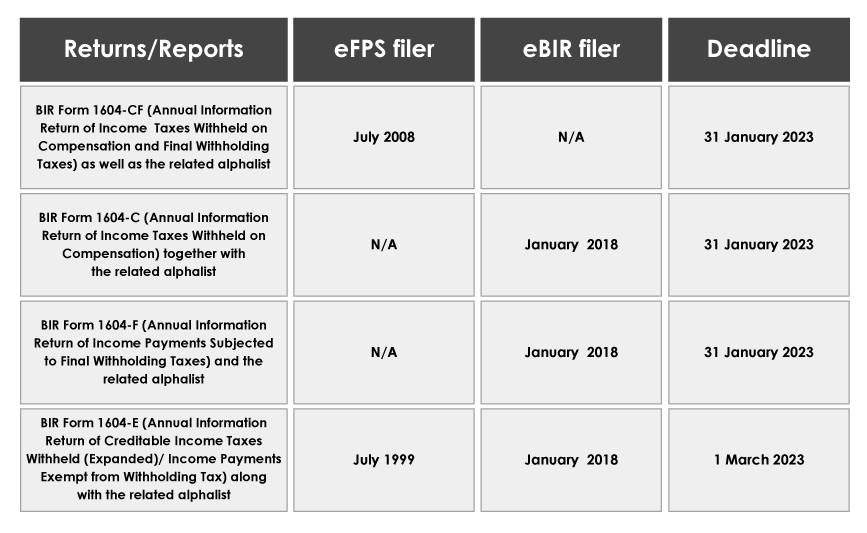

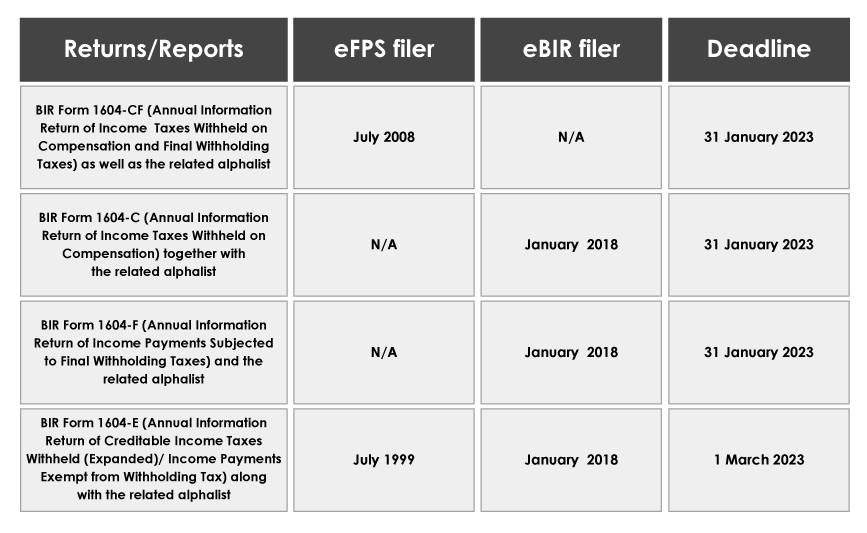

#2: Submission of Annual Information Returns

There are information and forms that must be filed to the BIR. Below are the following requirements and the deadline of submission:

#3: Submission of BIR Form 2316

The BIR Form 2316 is a return that details an employee’s income earned, with the corresponding tax withheld and remitted to BIR. Such is due for distribution and filing of the current and existing employee on or before January 31. Additionally, employers are required to submit a certified list of employees qualified for substituted filing with soft copies of BIR Form 2316 on or before February 28.

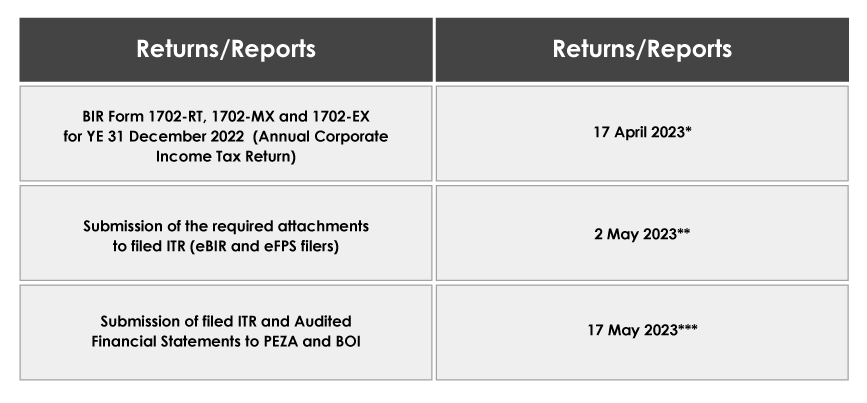

#4: Annual Income Tax Returns, Audited Financial Statements and Other Reports

For companies and taxpayers engaged in business activities, the following prerequisites must be submitted:

* For fiscal year companies, the deadline is the 15th day of the fourth (4th) month following the close of the fiscal year.

** For fiscal year companies, the deadline is within 15 days from the statutory due date or date of filing/payment of the ITR, whichever comes later.

*** For fiscal year companies, the deadline is within 30 days from the statutory due date or date of filing/payment of the ITR, whichever comes later.

Companies are required to have their financial statements audited by an Independent Certified Public Accountants (CPAs) if the following are met:

- Under Section 232 of the Tax Code revised RA 10963, corporations, companies, partnerships, or persons whose gross annual sales, earnings, receipts or output exceed P3,000,000; or

- Under SRC Rule 68, as Amended, the following are required to submit an audited financial statement to the Securities and Exchange Commission (SEC):

- Stock corporations with total assets or total liabilities of P600,000 or more

- Non-stock corporations with total assets of P600,000 or more

- Branch offices/Representative offices (RO) of stock foreign corporations with assigned capital in the equivalent amount of P1,000,000 or more

- Branch offices/RO of non-stock corporations with assets in the equivalent amount of P1,000,000 or more

- Regional operating headquarters of foreign corporations with total revenues in the equivalent amount of P1,000,000 or more

The deadline for the audited financial statement (AFS) to SEC is announced every January. In addition, SEC Memorandum Circular 6-2006 requires all domestic corporations with gross revenue of P5 million or more to submit the General Forms of Financial Statements within 30 days from the SEC deadline for AFS submission.

#5: Inventory Listing and Other Requirements

RMC No. 57-2015 requires taxpayers to submit a list of inventory such as finished goods, work in progress, raw materials, supplies, and stock-in-trade. You must also include other tangible asset-rich balance sheets, such as accounts receivable, and submit them on or before January 30 after each calendar year or within 30 days from the close of each fiscal year.

#6: Summary List of Tenants and Other Requirements

According to Revenue Regulation (RR) No. 12-2011, taxpayers engaging in the leasing or renting of property for commercial activities must submit the following:

- The layout of the leased property

- A certified true copy of the lease agreement per tenant

- Latest lessee information sheet (as of December 31)

Due dates may vary depending on which semester the list belongs to. If the list belongs to the second semester (July-December of the previous year), such must be filed by January 31. If the list belongs to the first semester (January-June of the current year), such must be filed by July 31.

#7: Sworn Declarations for 2023

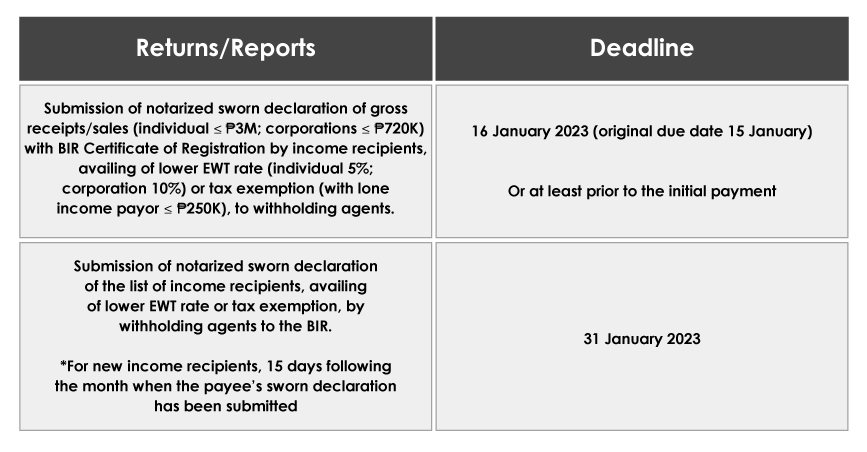

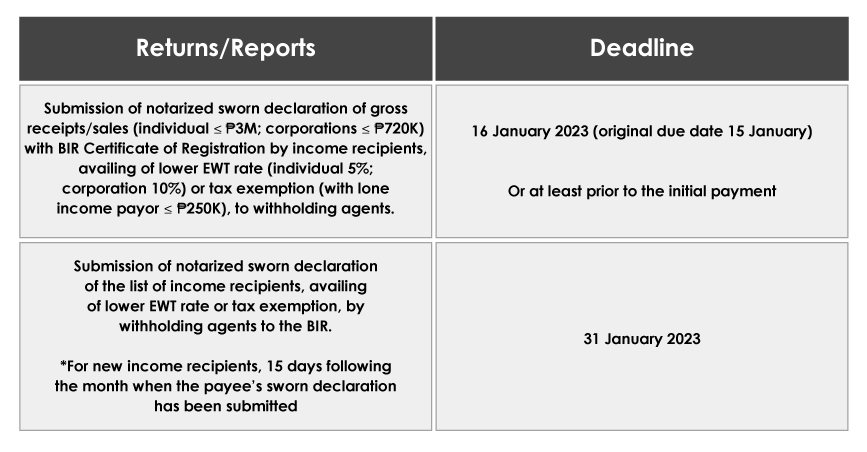

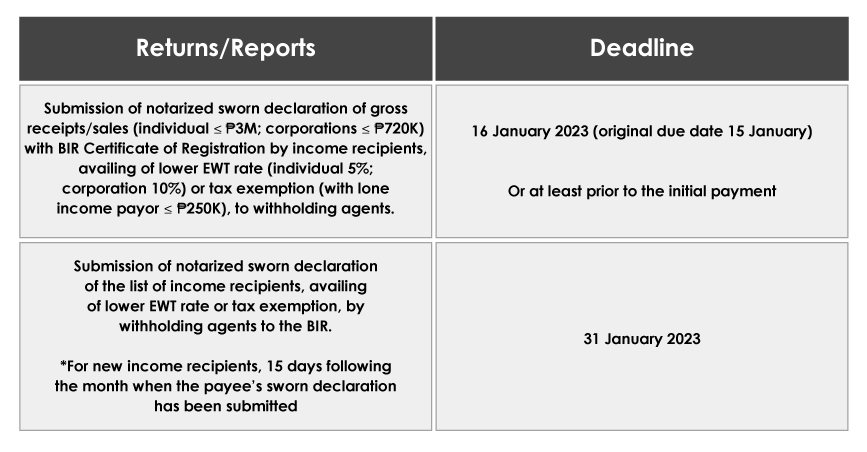

Under RR 11-2018, taxpayers are required to submit sworn declarations as follows:

#8: Other Reportorial Requirements

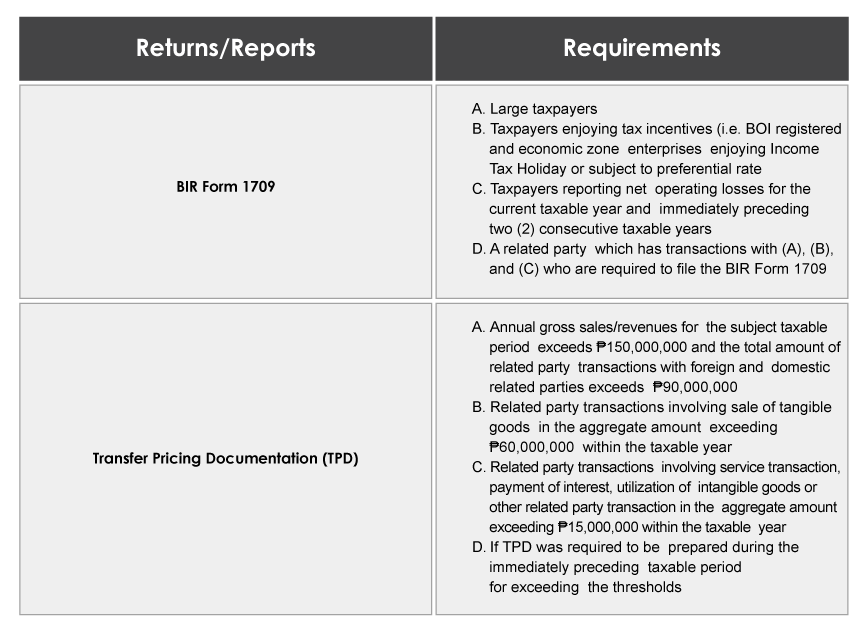

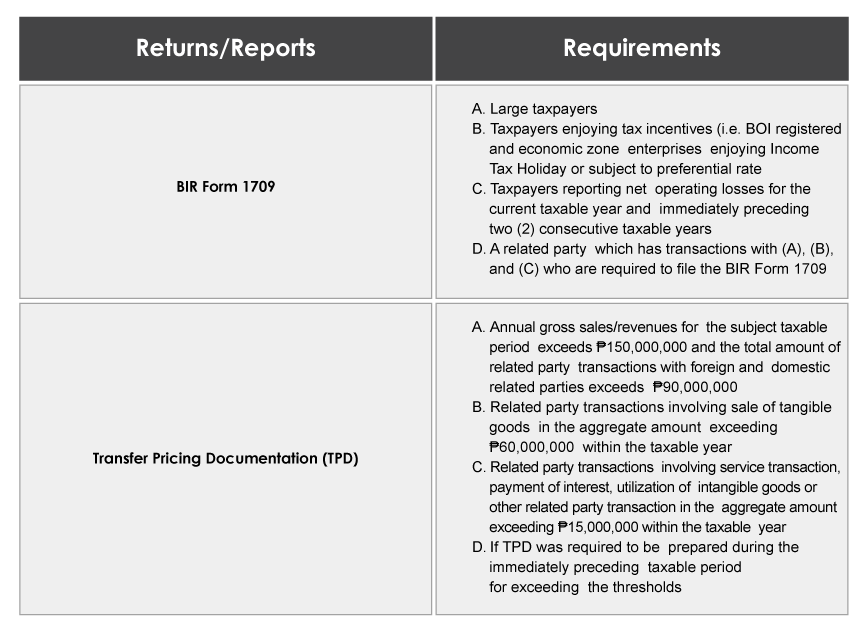

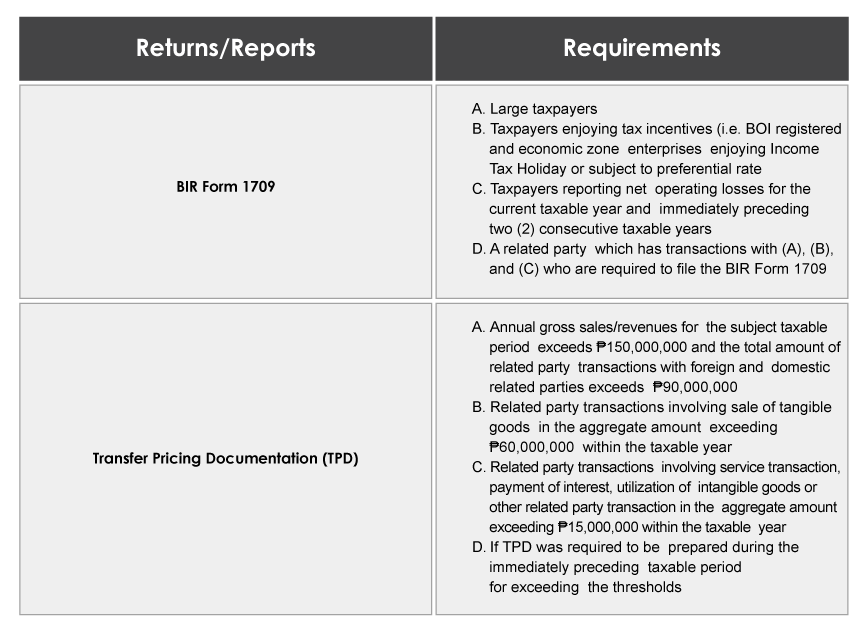

Under RR 34-2020 and RMC 54-2021, taxpayers are required to submit a summary information of their related party transactions (BIR Form 1709) and a Transfer Pricing Documentation, which are attachments to the Annual Income Tax Returns. The following must be met for the taxpayer to submit these reports:

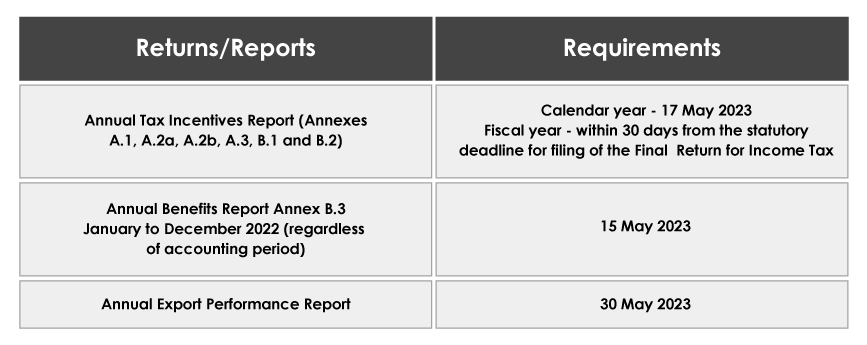

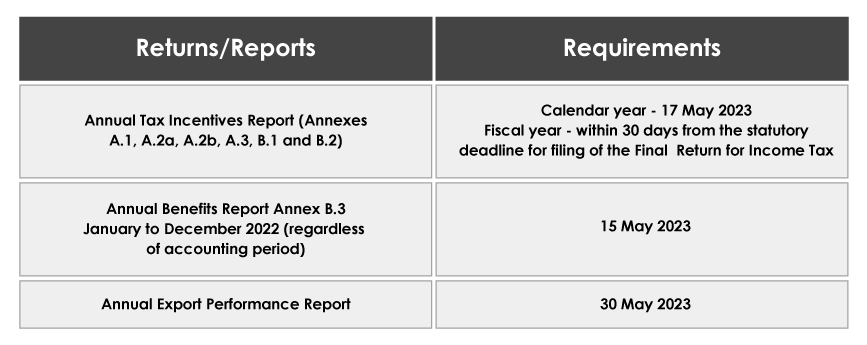

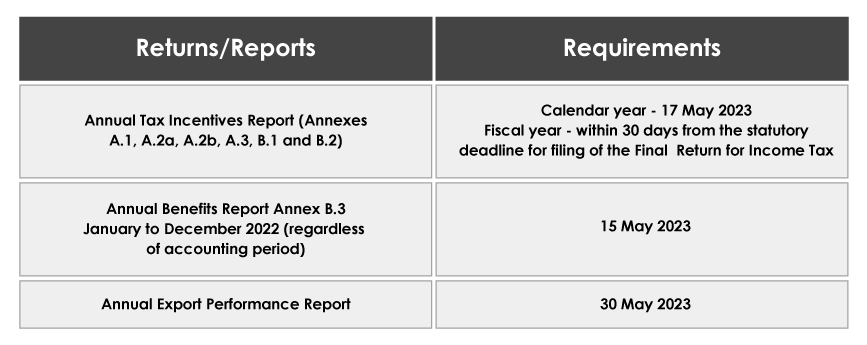

In addition, for taxpayers registered with Philippine Economic Zone Authority (PEZA) and Board of Investments (BOI), the following must be noted:

Development of Online Tax Filing and Payment System

To address the restrictions and health and safety protocols to fight the COVID-19 pandemic, BIR, along with numerous private institutions, made certain measures to provide tax reliefs to enterprises from reducing the percentage tax to developing online procedures to adhere to social distancing and health and safety protocols amid the COVID-19 pandemic.

BIR Electronic Filing and Payment Process

The Philippine administration, along with the help of BIR, made steps such as providing online and contactless transactions to ease tax compliance among enterprises amid the pandemic.

Here are the following developments in taxation made by BIR:

- Online payments through several BIR-accredited electronic payment channels

- Submission of soft copies of BIR form Nos. 2307 and 2316

- Allowed e-signature usage for some BIR forms

- Online TIN verification via BIR TIN verifier app

- Publishing educational videos about tax awareness

- Chatbot REVIE to assist taxpayers with general questions and inquiries

- Online booking of schedule for bureau appointments via BIR’s eAppointment System

Taxpayer Guidelines for Electronic Submission of Taxes

According to RMC 4-2021, the filing of Income Tax Returns (ITRs) can be made through manually or electronically mode. Taxpayers may use the Electronic Filing and Payment System (eFPS) or the eBIRForms software when submitting applicable taxes for their business. However, taxpayers specified in the circulars, such as those who are filing for “No Payment Returns,” must use eBIRForms only.

Taxpayers can also pay through online banking accredited by BIR:

- Development Bank of the Philippines (DBP)

- Land Bank of the Philippines (LBP)

- Union Bank Online Web and Mobile Payment Facility

- E-payment (G-Cash or Paymaya)

- I-Pay MYEG Philippines, Inc. (IPMP)

BIR reminds taxpayers to ensure strict compliance with regulations. Taxpayers who wrongfully submit and pay taxes through electronic means while being required to pay manually will be penalized for wrong venue filing.

In addition, under RMC 43-2021, the submission of the Annual Income Tax Returns and relevant attachments can be made thru BIR Electronic Audited Financial Statements (EAFS) System.

Furthermore, taxpayers under Section 116 of the Tax Code should keep in mind the provisions under RMC 67-2021, which provides the temporary reduction of tax percentage from 3% to 1% starting July 1, 2020, until June 30, 2023. The quarterly percentage tax returns filing deadline for the fourth quarter of the tax year 2021 is on or before January 25, 2022.

Secure Your Year-End Tax Compliance On Time

Sorting out your taxes at the end of the year requires a large amount of effort. Having a checklist can help you avoid overlooking several requirements and deadlines, keeping your company safe from any unwanted penalties as the year ends.

If the process becomes too confusing, you can always reach out to accounting, bookkeeping, and tax services providers to guide you through your company’s year-end tax compliance with BIR.