Implementation of the Quarterly Filing of VAT Returns Starting January 1, 2023

The Bureau of Internal Revenue (BIR) released an advisory (RMC No. 05-2023) informing internal revenue officers, taxpayers, and others concerned about the new filing and payment schedule in line with Section 37 of R.A No. 10963, also known as the “TRAIN LAW.”

According to Section 4-114-1 (A) of Revenue Regulations (RR) No. 13-2018, “Beginning January 1, 2023, the filing and payment required under this subsection shall be done within twenty-five (25) days following the close of each taxable quarter.”

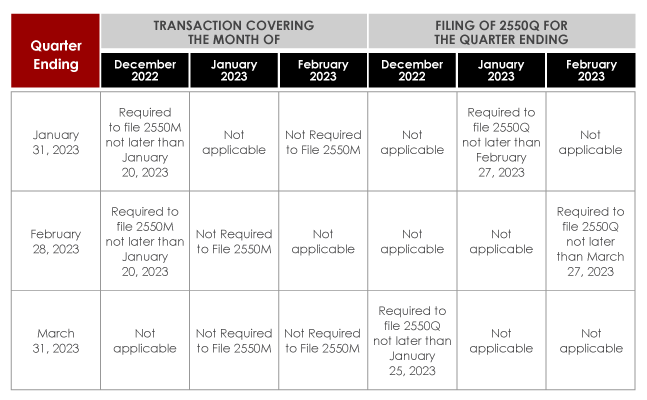

Below is the table containing the following transitory provisions to avoid confusion for taxpayers:

With this, VAT-registered taxpayers are no longer required to file the monthly Value-Added Tax Declaration (BIR Form No. 2550M) for transactions starting January 1, 2023. However, they are required to file the Quarterly Value-Added Tax Return (BIR Form 2550Q) within 25 days following the close of each taxable quarter when the transaction occurred.

Know When to File Your Value-Added Tax

VAT-registered taxpayers are required to file the monthly Value-Added Tax Declaration. However, with the recent release of the advisory containing amendments in Section 4-114-1 (A) of Revenue Regulations (RR) No. 13-2018, taxpayers must comply with the new schedule and form included in the provision. If you are having trouble understanding the new rule, you may seek help from accounting firms to assist you with your tax compliance.

Understand and Streamline Your Tax Compliance Process

Our experienced accountants can help you understand and streamline your tax compliance to avoid confusion regarding submission and payments.