Manage the Accounting of Your E-Commerce Business Effectively

With a large pool of experienced consultants, AHC can provide you with useful tools and methods to ensure that your accounting process is accurate and secure.

With a large pool of experienced consultants, AHC can provide you with useful tools and methods to ensure that your accounting process is accurate and secure.

Trisha Alexis Maingat is a Digital Marketing Specialist juggling ideas to produce concepts for digital and social media campaigns across various online channels. Aside from creative copies, Trish loves to write and contribute articles on topics such as labor and tax advisories, government updates, and business in the Philippines.

View all posts

The Bureau of Internal Revenue (BIR) releases Revenue Memorandum Circular (RMC) No. 38-2020, under the provisions of Revenue Regulations (RR) No. 4-2019 as amended by RR No. 5-2020, declaring changes on the duration for availment of Tax Amnesty on Delinquencies due to current circumstances.

The Bureau of Internal Revenue (BIR) released the guidelines for the issuance of a Tax Residency Certificate (TRC). This measure prevents unqualified taxpayers from availing tax treaty benefits and mandates the creation of a database of Filipino residents with foreign-sourced income.

The Bureau of Internal Revenue (BIR) prescribes the policies, guidelines and procedures in the conduct of the Online Pre-Employment Examination.

The BIR announced regulations on VAT zero-rating which covers IT and business process management businesses.

BIR creates the Alphanumeric Tax Code (ATC) for Excise Taxes on Exports of Sweetened Beverages Products paid through Payment Form – BIR Form No. 0605.

BIR clarifies the taxation of any income received by social media influencers.

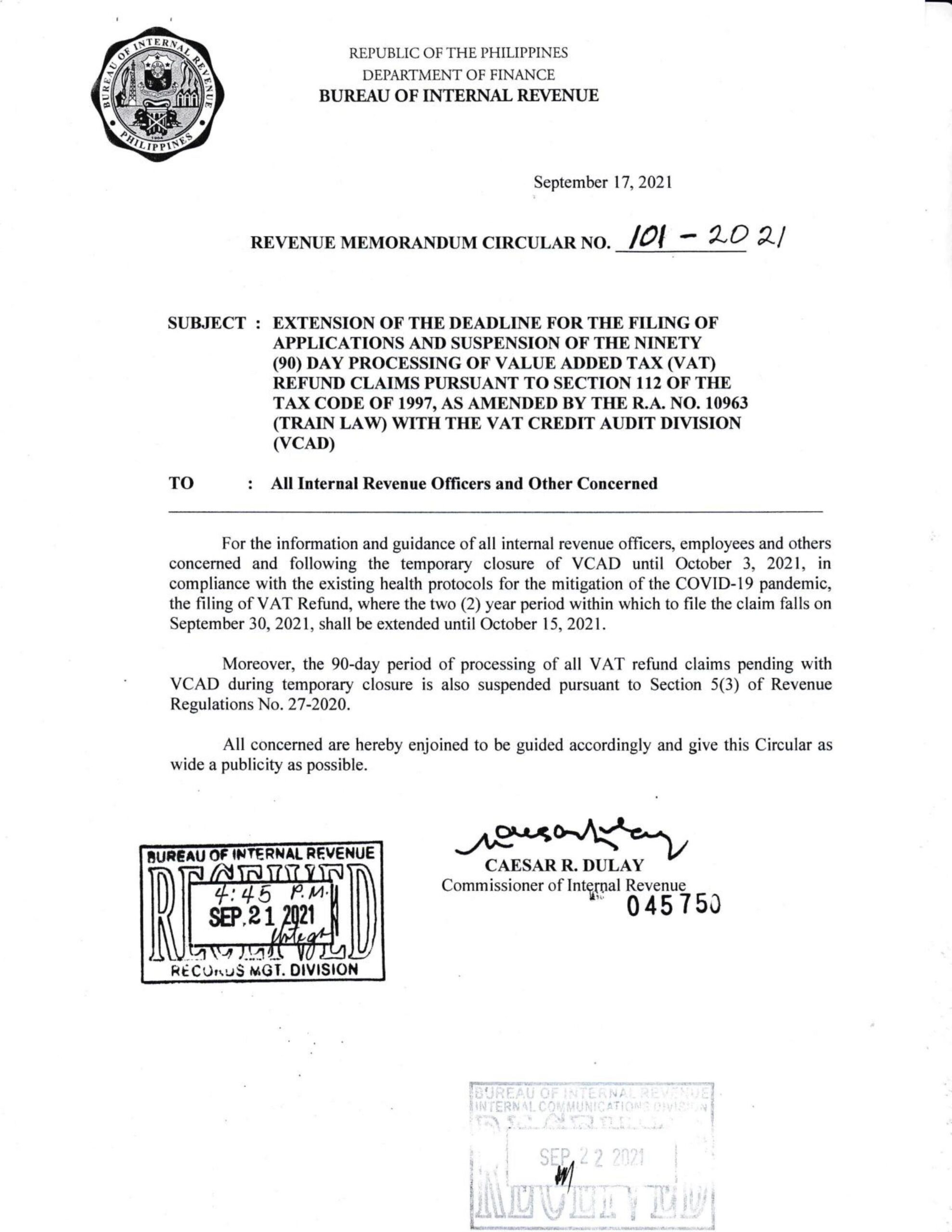

BIR extends the deadline for filing of position papers, replies, protests, documents and other similar letters and correspondences in relation to the ongoing BIR audit investigation and filing of VAT Refund with the VAT Credit Audit Division due to the declaration of ECQ and MECQ in the National Capital Region and other areas of the country.

The Bureau of Internal Revenue (BIR) releases Revenue Regulations (RR) No. 7-2020 which provides relief to taxpayers who are not able to settle the required documents and taxes subjected for submission, filing, and payments.

The Bureau of Internal Revenue (BIR) releases Revenue Memorandum Circular (RMC) No. 39-2020, under the provisions of Revenue Regulations (RR) No. 7-2020 and pursuant to Section 4(z) of the Republic Act (RA) No. 11469 or the “Bayanihan to Heal as One Act”, declaring changes in the statutory deadlines for filing and/or submission of certain documents, returns, and payment of certain taxes.

The Bureau of Internal Revenue (BIR) released a tax advisory, issued on March 30, clarifying the amount of tax payments relative to the eFPS facility — a BIR online system for computation of penalties.

The Bureau of Internal Revenue (BIR) circularizes the Consolidated Price of Sugar at Millsite for the Month of June 2021.

BIR prescribes the Consolidated Revenue Regulations on the affixture of Internal Revenue Stamps on imported and locally manufactured cigarettes, heated tobacco products and vapor products for domestic sale or for export and the use of the Enhanced Internal Revenue Stamp Integrated System (Enhanced IRSIS) for the ordering, distribution, monitoring, report generation and incorporating the strict supervision of production, release, affixture, inventory, and sale of cigarettes.

The Bureau of Internal Revenue (BIR) releases Revenue Memorandum Circular (RMC) No. 41-2020, relative to Proclamation No. 929 implementing the Enhanced Community Quarantine (ECQ) and Republic Act (RA) No. 11469 or the “Bayanihan to Heal as One Act”, clarifying extensions in the time of application for new Authority to Print (ATP) receipts and/or invoices of taxpayers.

The Bureau of Internal Revenue (BIR) reminds all political bets and parties of the 2019 midterm elections to submit their Statement of Contributions and Expenditures (SOCE) to the Commission on Elections (COMELEC) and their Revenue District Office (RDO) on or before June 13.

BIR amends RMC Nos. 55-2014, 66-2014, and 78-2014 to transfer the requirement for certification from the Food and Drug Administration (FDA) to the Bureau of Animal Industry.