A Complete Guide to Tax Mapping for Local and Foreign Enterprises in the Philippines

As part of running a business in the Philippines, the law requires local and foreign enterprises to be fully compliant with current tax laws on a daily basis. Ensuring that your business is up-to-date with such laws will keep you from receiving penalties from the Bureau of Internal Revenue (BIR) during tax mapping.

Tax mapping in the Philippines can be a challenging and exhaustive process. From documentary requirements to non-compliance penalties, we listed everything you need to know to guide you through the tax mapping process in the Philippines and secure proper compliance for your business.

Tax Mapping in the Philippines

In 2003, BIR introduced the Tax Compliance Verification Drive (TCVD) program, also known as tax mapping, to further expand the tax base and enhance tax compliance of businesses in the country. The program allows BIR to assign authorized examiners to visit companies and verify their compliance with current tax laws.

BIR Procedures During Tax Mapping

BIR issues several notices to allow companies to prepare the necessary documents needed for tax mapping. BIR will issue a Reminder Letter to all establishments to be visited at the start of the tax mapping process.

In the letter, BIR will specify the following:

- Enumeration of requirements for businesses

- List of BIR requirements before, during, and after operations of a business.

- List of BIR forms along with deadlines for filing and payment requirements of the corresponding taxes.

The Reminder Letter will serve as a guide on what you must secure during tax mapping. The visitation date of each establishment is not specified in the letter. However, BIR generally provides two weeks for establishments to prepare before visitation.

Coverage of Tax Mapping

During tax mapping, BIR usually checks the following:

- Taxpayer’s registration of head office and branches (BIR Form No. 2303) along with related updates thereto and posting the same in a conspicuous place

- Payment of annual registration fee (BIR Form No. 0605) and posting the same in a conspicuous place

- Authority to print receipts and invoices, issuance of such receipts and invoices of every sale of services and goods, and contents of receipts and invoices under the rule on invoicing requirements

- Registration of cash register machines (CRM), point-of-sale (POS) machines, and computerized accounting system (CAS)

- Display of registration notices and other related requirements

- Registration of books of accounts in the Philippines to manual and simplified books or BIR approval on loose-leaf books of accounts and compliance with bookkeeping regulations

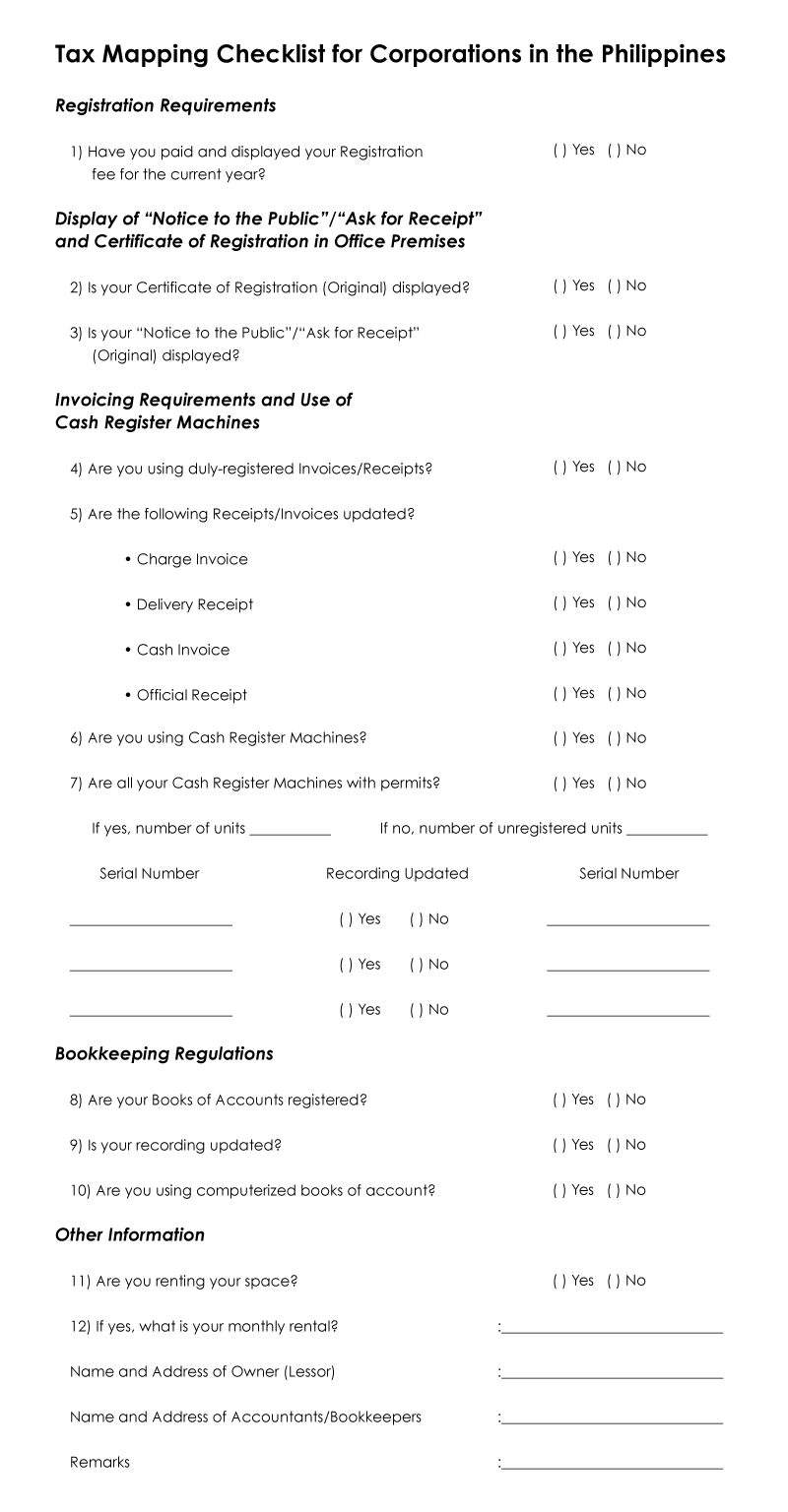

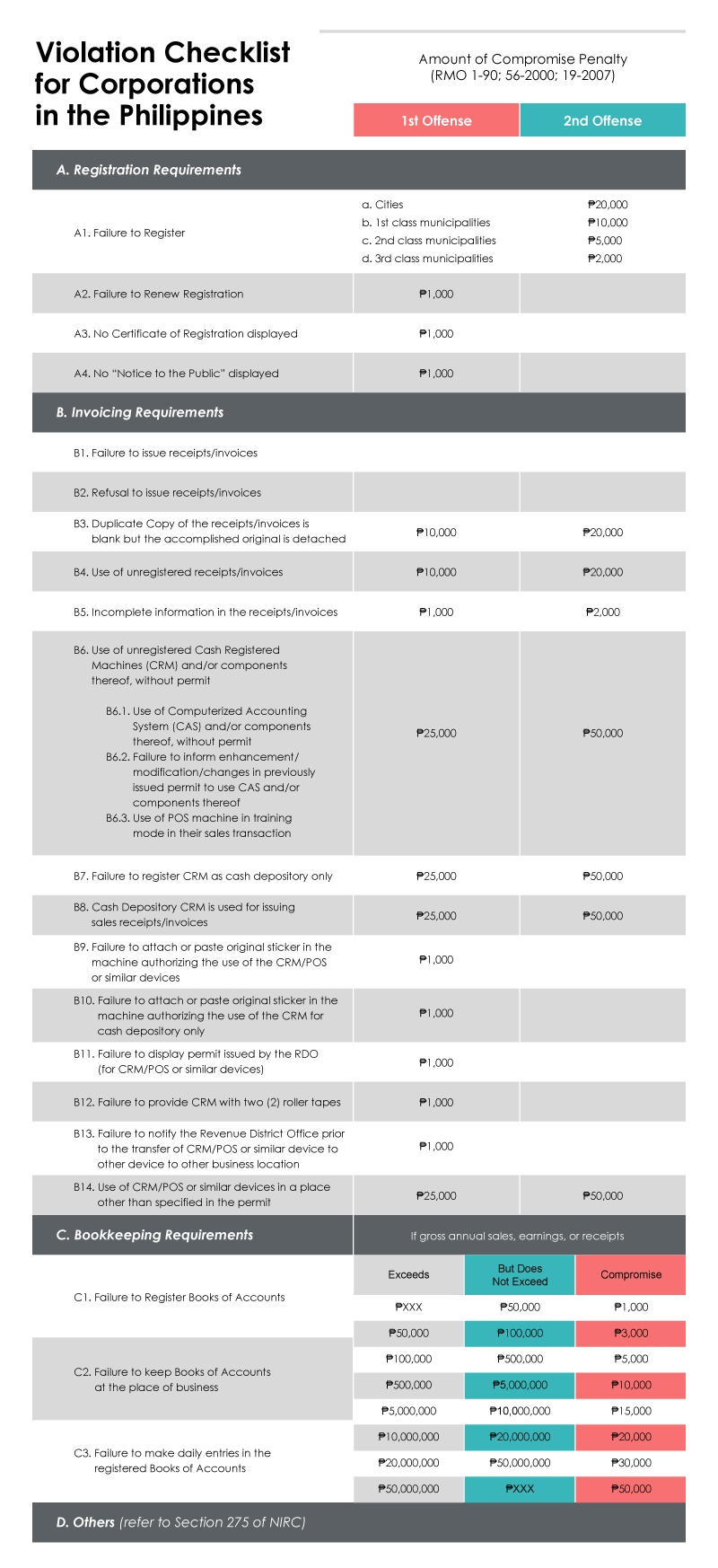

The number of requirements can be overwhelming. To help you avoid overlooking essential details during tax mapping, here is an easy-to-digest checklist to help you through your preparation:

Tax Mapping in the Philippines is separate from the three-year and ten-year tax assessment. The process is simply to ensure that all establishments in the Philippines are compliant with the latest tax regulations.

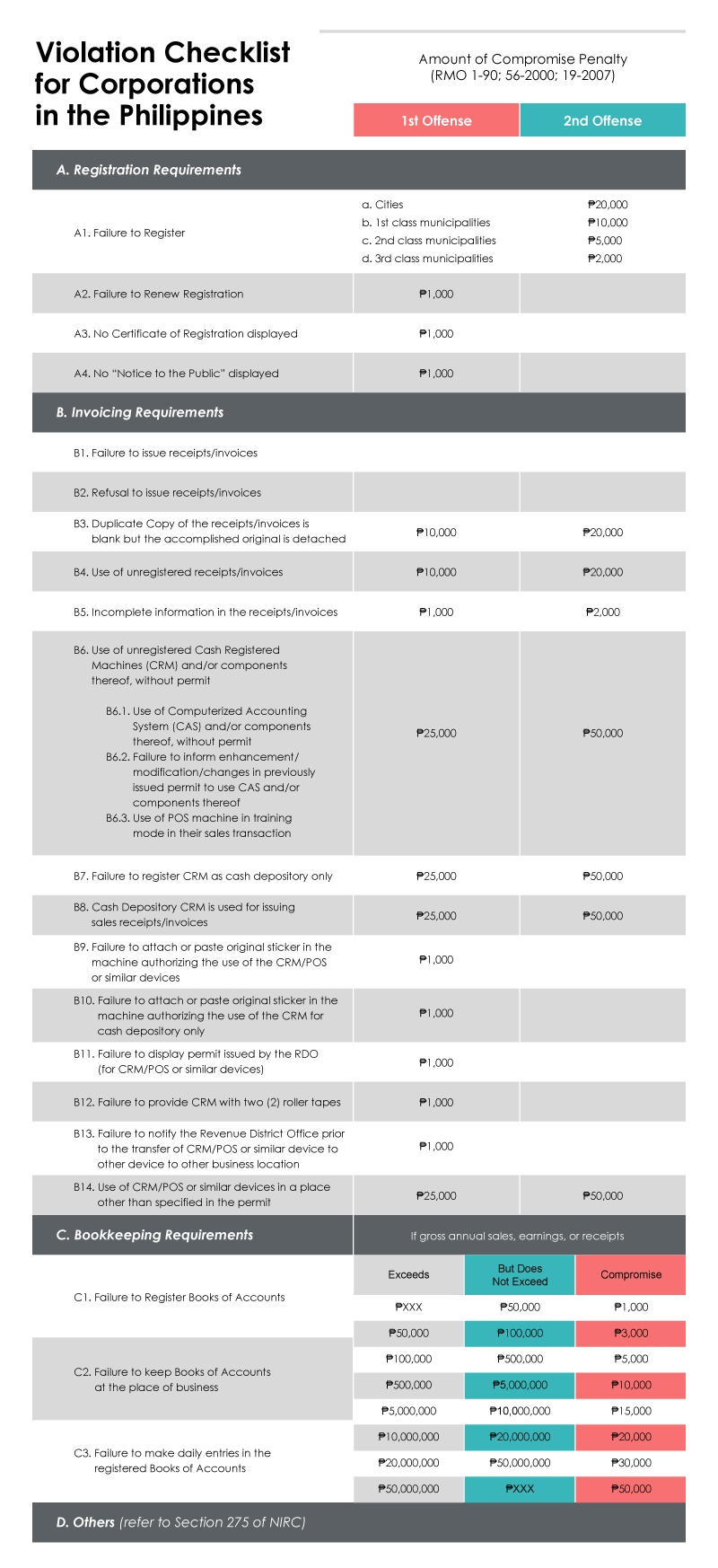

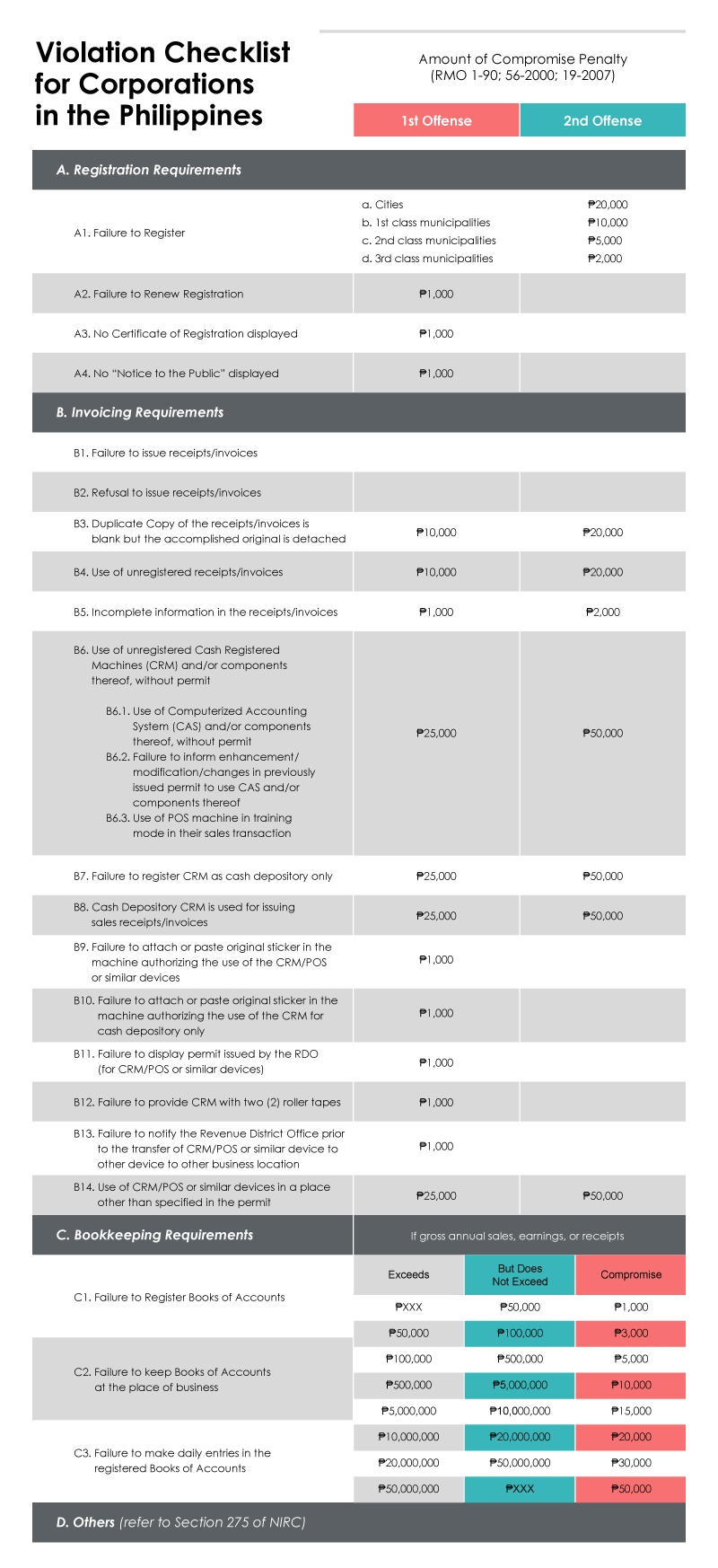

BIR Penalties for Violation During Tax Mapping

Enterprises that cannot meet the requirements during tax mapping will be subject to fees and penalties provided by BIR. Listed below are the penalties for different tax mapping violations as provided in the National Internal Revenue Code (NIRC).

Prepare Your Business for Tax Mapping in the Philippines

As an entrepreneur, it is essential to ensure that your business is up-to-date with the latest tax compliance laws to avoid penalties from the BIR. Knowing when and what to prepare allows you to confidently welcome BIR examiners during your tax mapping process.

If you find such procedures exhaustive, it is wise to reach out to tax, accounting, and bookkeeping service providers to guide you through the tax mapping process in the Philippines.

RELATED: A Complete Checklist of Year-End Tax Compliance for Corporations in the Philippines

Secure Tax Compliance for Your Business in the Philippines

With a full suite of tax and corporate compliance services, our team is dedicated to helping your company stay compliant with the latest tax laws and regulations.

What is Tax Mapping?

Tax Mapping is where the Bureau of Internal Revenue (BIR) visits your company to check whether you are fully compliant with the latest tax laws and regulations.

What does BIR check during tax mapping?

BIR usually covers the following documents during tax mapping:

- BIR Form No. 2303

- BIR Form No. 0605

- Authority to print receipts and invoices

- Registration of cash register machines (CRM), point-of-sale (POS) machines, and computerized accounting system (CAS), and similar

- Registration of Books of Accounts

How long can you prepare before BIR examiners visit you for tax mapping?

BIR usually issues a letter of reminder to all establishments before visiting them for tax mapping. They usually give 2 weeks from the date of release of the letter.