As a business owner in the Philippines, it is wise to ensure that your company’s accounts are always ready for audits throughout the year.

Admin

As an e-commerce entrepreneur, it is imperative to ensure that you are knowledgeable about the basics of managing your accounts.

Many startups have limited budgets and operate on thin profit margins. There isn’t much room for error, and handling finances strategically is critical to success.

During his fourth State of the Nation Address, President Rodrigo Duterte requested the Congress to pass the “Tax Reform for Attracting Better and Higher-quality Opportunities” bill, more commonly known as TRABAHO bill.

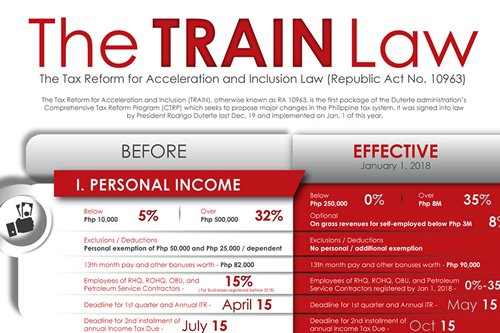

RA. 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) seeks to propose major changes in the Philippine tax system. It was signed into law by President Rodrigo Duterte on December 19, 2017.

When your local business is already in operational status, this means that you have to pay your taxes and other dues to the government. In this article, we will discuss two types of taxes in the Philippines: National and Local taxes.

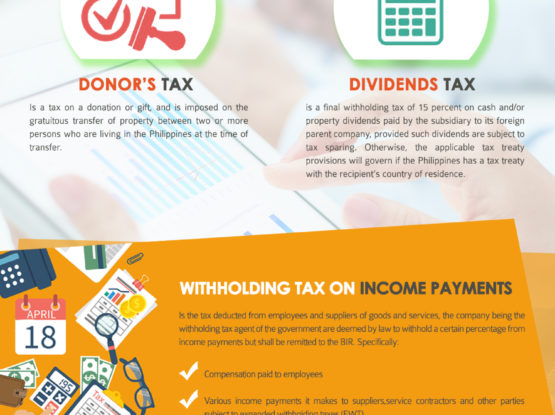

It has become simplier for non-residents to enjoy preferential withholding tax rates for dividends, interest, and royalty earnings from domestic sources. The Bureau of Internal Revenue has issued new procedures to claim preferential tax treaty benefits for nonresidents covered by tax treaties signed by the Philippines with other countries.

Required Submission of Audited Financial Statements and Income Tax Return to SEC and BIR (February 22, 2017) Please be reminded that…