As a self-employed entrepreneur, you must be familiar with the applicable tax obligations with BIR as an influencer in the Philippines.

Infographics

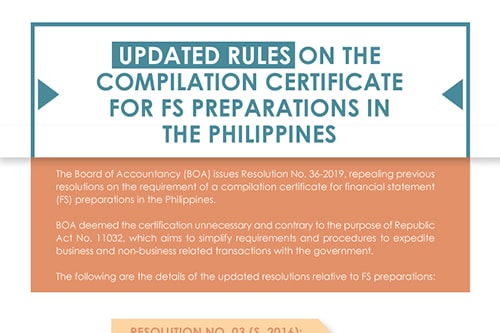

The Board of Accountancy (BOA) issues Resolution No. 36-2019, repealing previous resolutions on the requirement of a compilation certificate for financial statement (FS) preparations in the Philippines.

We provide a visual guide to help taxpayers prepare and submit their income tax returns (ITRs) in the Philippines, from manual filing, eFPS, and eBIRForms.

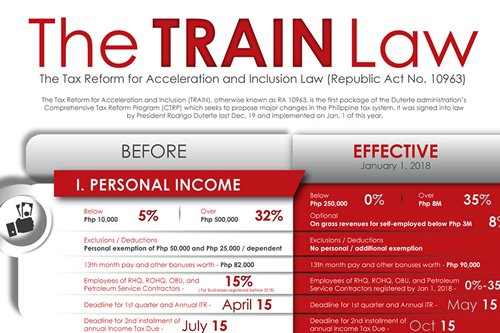

RA. 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) seeks to propose major changes in the Philippine tax system. It was signed into law by President Rodrigo Duterte on December 19, 2017.

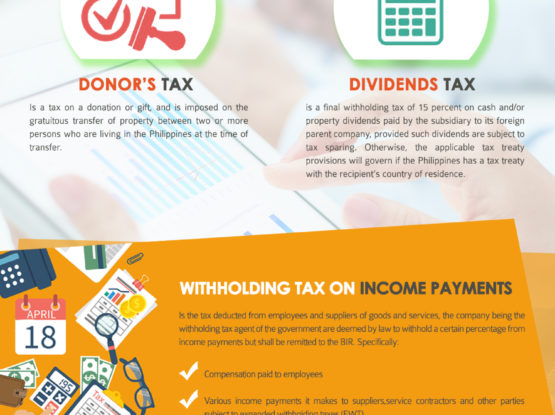

When your local business is already in operational status, this means that you have to pay your taxes and other dues to the government. In this article, we will discuss two types of taxes in the Philippines: National and Local taxes.