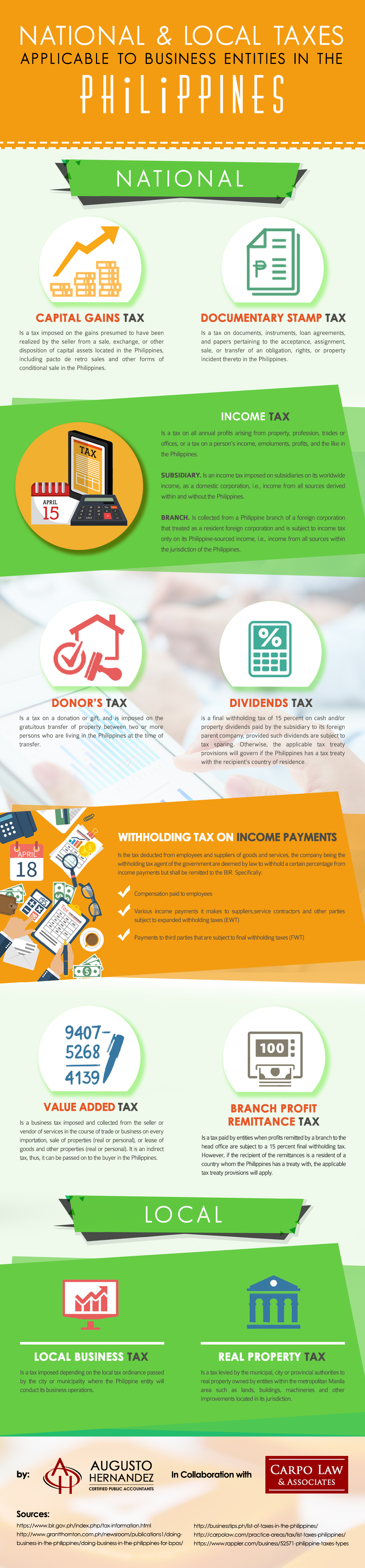

National and Local Taxes Applicable to Business Entities in the Philippines

When your local business is already in operational status, this means that you have to pay your taxes and other dues to the government. But if you are a foreign investor who would like to set up operations in the Philippines, you probably want to know the kinds of taxes that you need to pay for.

Listed below are some of the types of national and local taxes that business entities operating in the Philippines have to deal with:

National Taxes

Capital Gains Tax

Is a tax imposed on the gains presumed to have been realized by the seller from a sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sales and other forms of conditional sale in the Philippines.

Documentary Tax

Is a tax on documents, instruments, loan agreements, and papers pertaining to the acceptance, assignment, sale, or transfer of an obligation, rights, or property incident thereto in the Philippines.

Income Tax

Is a tax on all annual profits from property, profession, trades or offices, or tax on a person’s income, emoluments, profits, and the like in the Philippines.

- Subsidiary – is an income tax imposed on its worldwide income, as a domestic corporation, i.e., income from all sources derived within and without the Philippines.

- Branch – is collected from a Philippine branch of a foreign corporation that treated as a resident foreign corporation and is subject to income tax only on its Philippine-sourced income, i.e., income from all sources within the jurisdiction of the Philippines.

Donor’s Tax

Is a tax on a donation or gift, and is imposed on the gratuitous transfer of property between two or more persons who are living in the Philippines at the time of transfer.

Dividends Tax

Is a final withholding tax of 15 percent on cash and/or property dividends paid by the subsidiary to its foreign parent company, provided such dividends are subject to tax sparing. Otherwise, the applicable tax treaty provisions will govern if the Philippines has a tax treaty with the recipient’s country of residence.

Withholding Tax on Income Payments

Is the tax deducted from employees and suppliers of goods and services, the company being the withholding tax agent of the government are deemed by law to withhold certain percentage from income payments but shall be remitted to the BIR. Specifically:

- Compensation paid to employees

- Various income payments it makes to suppliers, service contractors and other parties subject to expanded withholding taxes (EWT)

- Payments to third parties that are subject to final withholding taxes (FWT)

Value Added Tax (VAT)

Is a business tax imposed and collected from the seller or vendor services in the course of trade or business on every importation, sale of properties (real or personal), or lease of goods and other properties (real or personal). It is an indirect tax, it can be passed onto the buyer in the Philippines.

Branch Profit Remittance Tax

Is a tax paid by entities when profits remitted by a branch to the head office are subject to 15 percent final withholding tax. However, if the recipient of the remittances is a resident of a country whom the Philippines has a treaty with, the applicable tax treaty provisions will apply.

Local Taxes

Local Business Tax

Is a tax imposed depending on the local tax ordinance passed by the city or municipality where the Philippine entity will conduct its business operations.

Real Property Tax

Is a tax levied by the municipal, city or provincial authorities to real property owned by entities within the metropolitan Manila area such as lands, buildings, machineries, and other improvements located in its jurisdiction.