BIR Further Extends the Deadline on Availment of Tax Amnesty on Delinquencies in the Philippines

The Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular (RMC) No. 61-2020 to further amend the provisions of Revenue Regulations (RR) No. 4-2019, as previously amended by RR NO. 5-2020 and RR No. 11-2020.

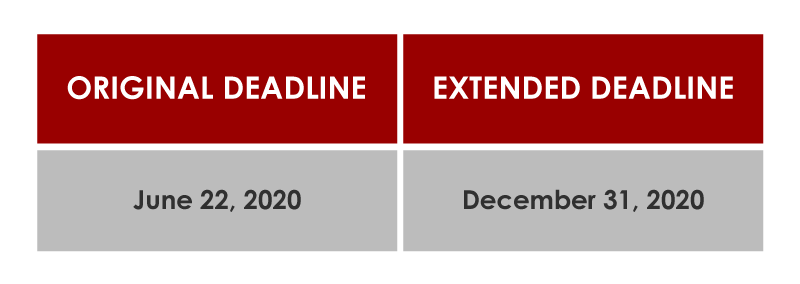

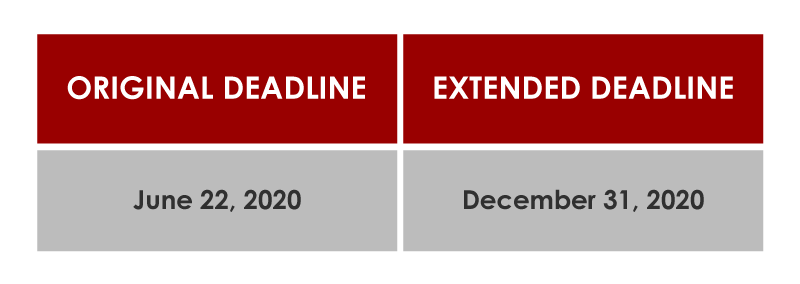

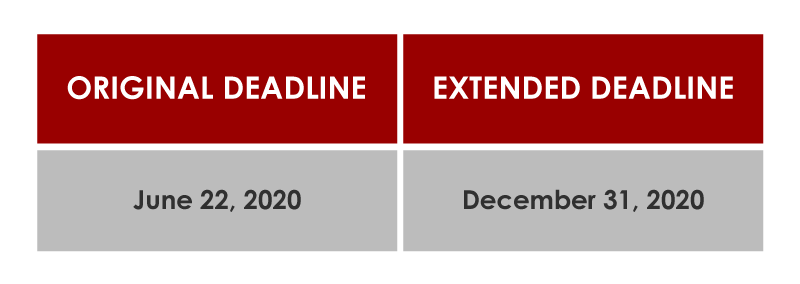

EXTENSION

The circular declares the supplemental extension on the availment duration of tax amnesty on delinquencies.

PURPOSE

The Bureau seeks to continuously provide relief to businesses in the Philippines relative to declared deadlines during the COVID-19 pandemic.