BIR Releases Amendments on Period and Manner of Availment of Tax Amnesty on Delinquencies in the Philippines

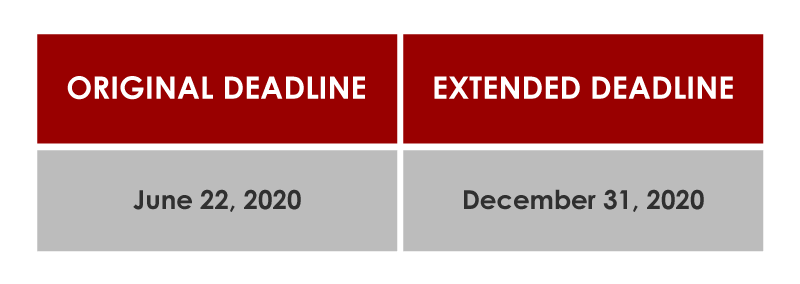

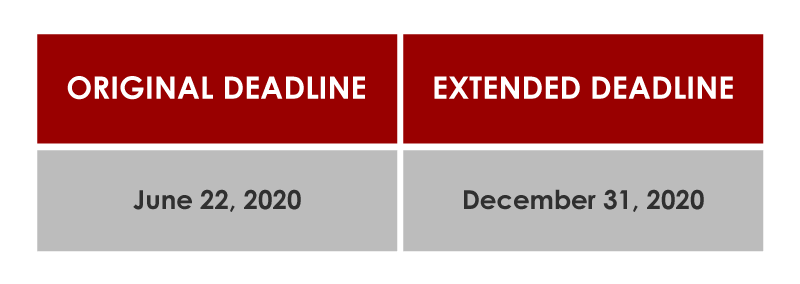

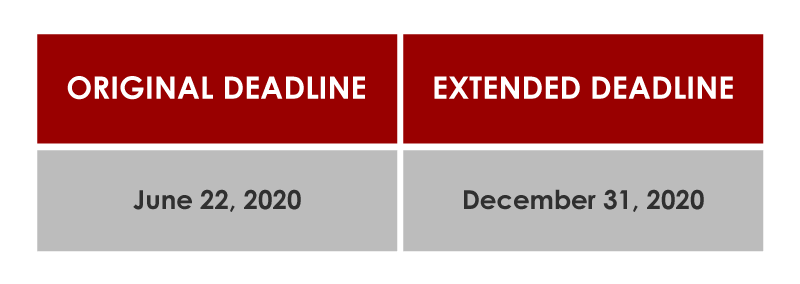

The Bureau of Internal Revenue (BIR) released Revenue Regulations (RR) No. 15-2020 to amend certain provisions of the RR No. 4-2019 relative to Tax Amnesty on Delinquencies (TAD). Under the released amendments, BIR further extends the deadline on the availment of tax amnesty on delinquencies and suspends the due dates for filing and application within the period of the community quarantine.

ADJUSTMENTS ON THE APPLICATION DEADLINE

PROCEDURES ON THE AVAILMENT

ON SECURING THE CERTIFICATE OF DELINQUENCIES/TAX LIABILITIES

Concerned BIR office shall be given a deadline of three (3) working days to issue the Certificate of Tax Delinquencies/Tax Liabilities upon receipt of the request. In case the issuance of certificates be denied, the BIR shall provide in writing a legal and factual basis of the denial.

ON THE ACCOMPLISHMENT OF TAR AND APF

BIR shall be given one (1) working day to endorse for payment the duly completed Tax Amnesty Return (TAR) and Acceptance Payment Form (APF) from the date of receipt of all the accomplished documents.

Full compliance on the availment of tax delinquencies shall only be considered upon fulfillment of the steps indicated in these regulations and within the period of the new deadline.