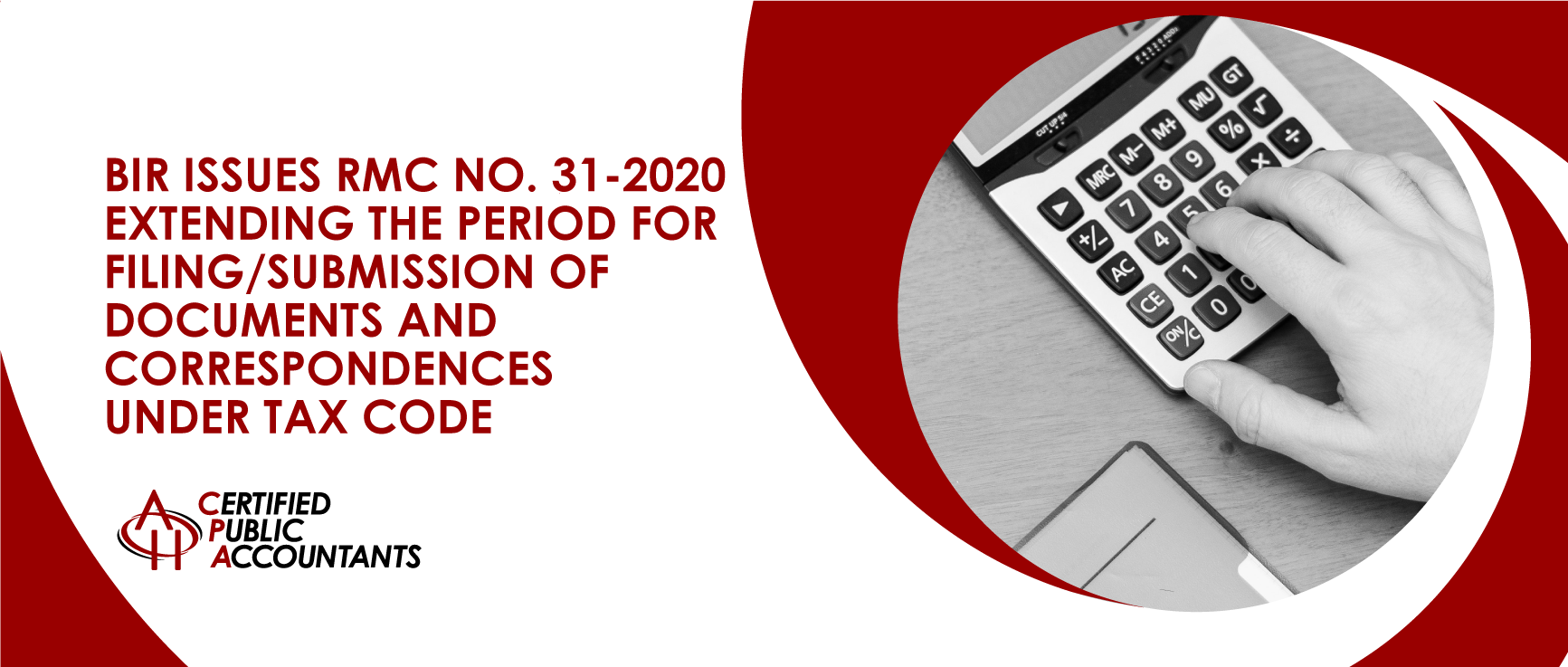

BIR Issues RMC No. 31-2020 Extending the Period for Filing/ Submission of Documents/ Correspondences Under Tax Code

| DOCUMENT/ CORRESPONDENCE | EXTENSION |

| Letter Answer to Notice of Informal Conference (NIC) | Extension of thirty (30) days from the date of the lifting of the ECQ |

| Response to the Preliminary Assessment Notice (PAN) | |

| Protest Letter to Final Assessment Notice (FAN)/ Formal Letter of Demand (FLD) | |

| Submission of relevant supporting documents to support the request for re-investigation of audit cases with FAN/FLD | |

| Appeal/ Request for Reconsideration to the Commissioner on the Final Decision on Disputed Assessment (FDDA) | |

| Other similar letters and correspondences with due dates |

The extension is applicable to taxpayers whose response to their NIC, PAN, FAN, FLD, FDDA, and other similar notices fall due on dates within the period of ECQ.

*This circular applies to jurisdictions where LGUs have adopted and implemented ECQ.