BIR Releases Deadline for Filing of Annual Income Tax Returns and Attachments in the Philippines

The Bureau of Internal Revenue (BIR), in an advisory published on April 28, released the deadlines for the filing of amended Annual Income Tax Returns (AITRs) and required attachments in the electronically-filed AITR of the taxable period ending on December 31, 2020. The Bureau strictly reminds taxpayers the due dates for filing to avoid penalties.

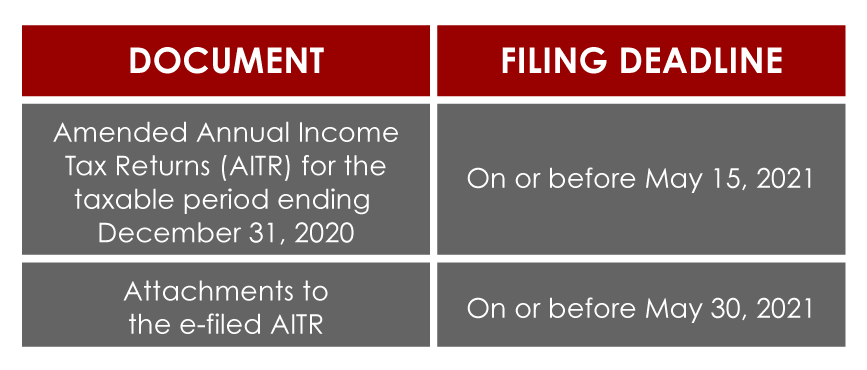

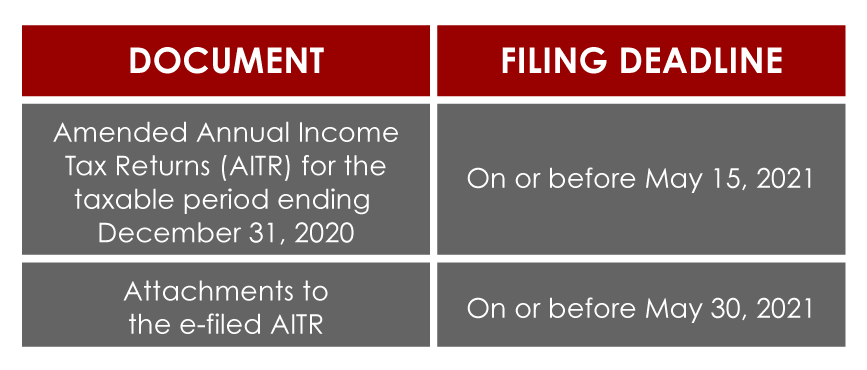

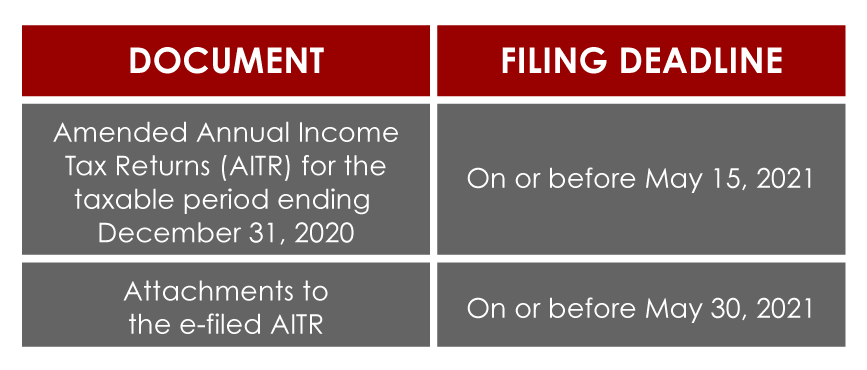

FILING DEADLINES

This advisory covers due dates for the filing of both AITR and its attachments as follows:

SUBMISSION PROCESS

The submission of attachments to the e-filed AITR shall be through Electronic Audited Financial Statement (eAFS) System or to the Revenue District Office (RDO) where the taxpayer is registered.

OTHER DETAILS

The submission of attachments to tentative AITR e-filed on or before April 15, 2021 shall also be subject to the deadline on or before May 30, 2021.

The above-similar deadline shall be followed by taxpayers who intend to amend their returns regardless if due to tax rate corrections or not. Resubmission of attachments to the AITR is not required provided that no revisions and/or changes arise from the amendment of documents already submitted.

PENALTIES

Taxpayers shall not bear any penalty for non-submission of attachments to filed AITR provided it is later amended on or before May 15, 2021.