Manage the Accounting of Your E-Commerce Business Effectively

With a large pool of experienced consultants, AHC can provide you with useful tools and methods to ensure that your accounting process is accurate and secure.

With a large pool of experienced consultants, AHC can provide you with useful tools and methods to ensure that your accounting process is accurate and secure.

Trisha Alexis Maingat is a Digital Marketing Specialist juggling ideas to produce concepts for digital and social media campaigns across various online channels. Aside from creative copies, Trish loves to write and contribute articles on topics such as labor and tax advisories, government updates, and business in the Philippines.

View all posts

The Bureau of Internal Revenue (BIR) releases Revenue Regulations (RR) No. 10-2020, pursuant to section 4(z) of the Republic Act No. 11469, otherwise known as “Bayanihan to Heal as One Act”, amending Section 2 of the RR No. 7-2020 further extending the deadlines for submission, filing, and payment of significant documents and/or taxes due to prolonged implementation of the Enhanced Community Quarantine (ECQ) until April 30, 2020.

Businesses operating in the Philippines are required to submit the required documents for their taxes. This article will discuss BIR form 1709 and TPD.

BIR was lauded for its efforts in putting services closer to taxpayers in the Philippines

The Bureau of Internal Revenue (BIR) launched a competition meant for the creation of a convenient mobile taxpayer service to streamline the current procedure for registration, filing, and payment of taxes. BIR launched the competition on October 16, 2019.

The Bureau of Internal Revenue (BIR) releases Revenue Regulations (RR) No. 7-2020 which provides relief to taxpayers who are not able to settle the required documents and taxes subjected for submission, filing, and payments.

BIR prescribes the Consolidated Revenue Regulations on the affixture of Internal Revenue Stamps on imported and locally manufactured cigarettes, heated tobacco products and vapor products for domestic sale or for export and the use of the Enhanced Internal Revenue Stamp Integrated System (Enhanced IRSIS) for the ordering, distribution, monitoring, report generation and incorporating the strict supervision of production, release, affixture, inventory, and sale of cigarettes.

BIR further amends pertinent provisions of RR Nos. 2-2006 and 11-2013, as amended by RR No. 2-2015, more particularly on the manner of submission of copies of BIR Form Nos. 2307 and 2316.

The Bureau of Internal Revenue (BIR) releases Revenue Memorandum Circular (RMC) No. 38-2020, under the provisions of Revenue Regulations (RR) No. 4-2019 as amended by RR No. 5-2020, declaring changes on the duration for availment of Tax Amnesty on Delinquencies due to current circumstances.

The Bureau of Internal Revenue (BIR) proposes Revenue Regulations to implement certain sections of the NIRC of 1997 (Tax Code), as Amended.

The Bureau of Internal Revenue (BIR) started accepting applications from heirs who have to pay for the estate tax dues accumulated by their deceased loved ones. The issuance provides taxpayers with an estate tax amnesty program that gives reasonable tax relief to the outstanding liabilities of heirs from the inheritance of the decedent’s estate.

The Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) No. 112-2020 clarifying the postponement of effectivity of the enlisted and delisted taxpayers of the Large Taxpayers Service (LTS) to January 1, 2021, relative to the memorandum released by the Bureau on September 21, 2020.

Author Trisha Alexis Maingat Trisha Alexis Maingat is a Digital Marketing Specialist juggling ideas to produce concepts for digital and…

The Bureau of Internal Revenue (BIR) released a tax advisory, issued on March 30, clarifying the amount of tax payments relative to the eFPS facility — a BIR online system for computation of penalties.

The Bureau of Internal Revenue (BIR) appeals to lawmakers to pass a general tax amnesty law supporting the ₱4.5 trillion outlay for the national government for 2021.

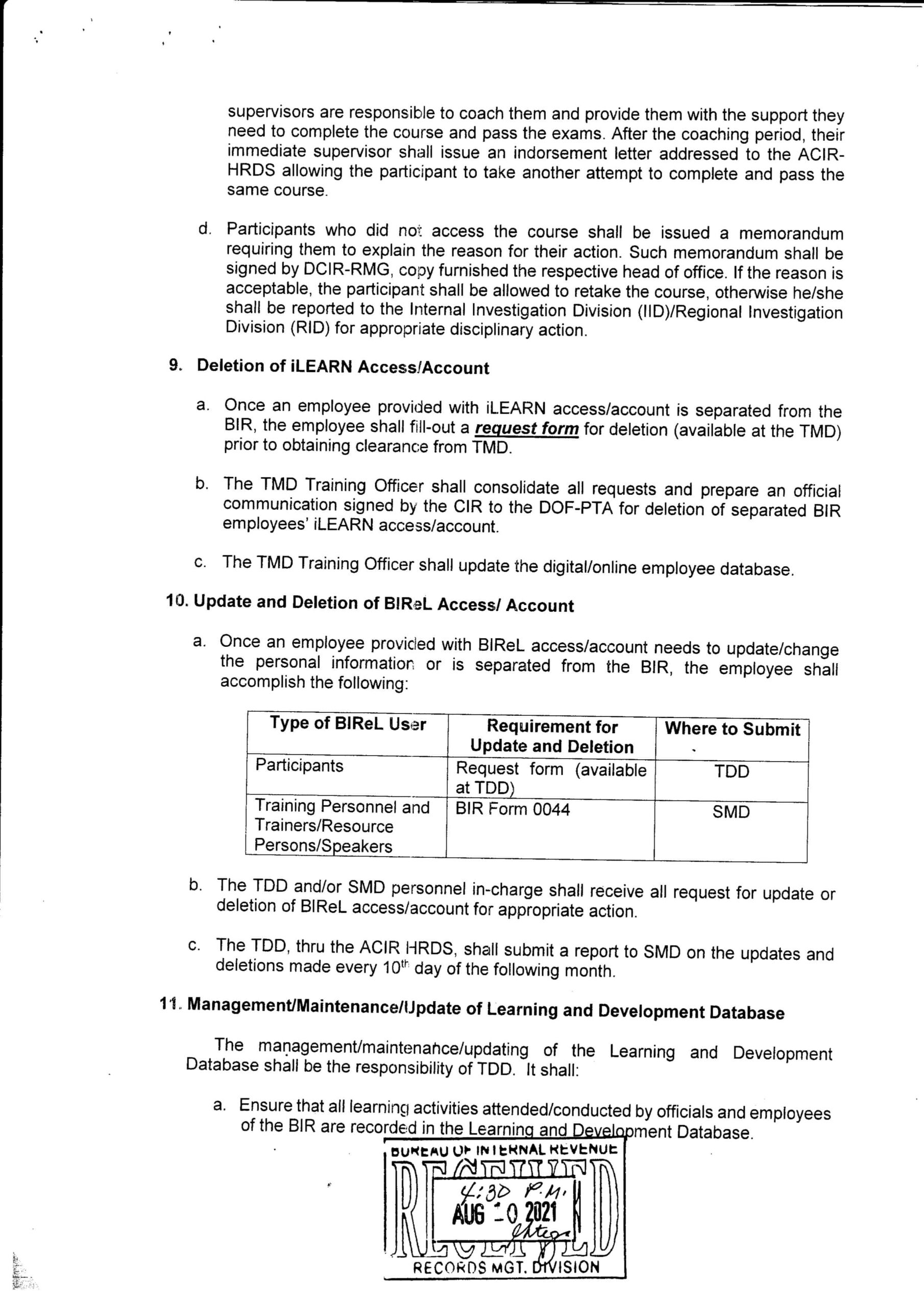

Revenue Region No. 5-Caloocan City will be conducting a public auction of all seized real properties located within its jurisdiction on September 28, 2021 (9:00 AM) at 6th Floor, BIR Regional Office Building, EDSA Caloocan City.