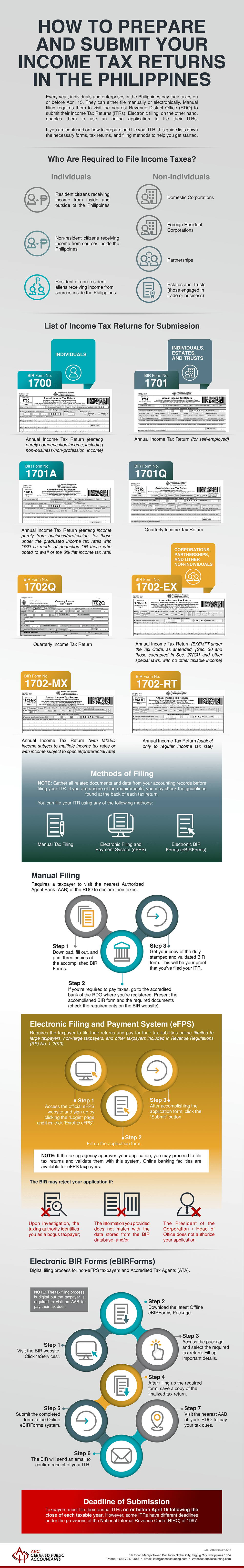

How to Prepare and Submit Your Income Tax Returns in the Philippines

Every year, individuals and enterprises in the Philippines pay their taxes on or before April 15. They can either file manually or electronically. Manual filing requires them to visit the nearest Revenue District Office (RDO) to submit their Income Tax Returns (ITRs). Electronic filing, on the other hand, enables them to use an online application to file their ITRs.

If you are confused on how to prepare and file your ITR, this guide lists down the necessary forms, tax returns, and filing methods to help you get started.

Who Are Required to File Income Taxes?

Individuals

- Resident citizens receiving income from inside and outside of the Philippines

- Non-resident citizens receiving income from sources inside the Philippines

- Resident or non-resident aliens receiving income from sources inside the Philippines

Non-Individuals

- Domestic Corporations

- Foreign Resident Corporations

- Partnerships

- Estates and Trusts (those engaged in trade or business)

List of Income Tax Returns for Submission

| Individuals | Individuals, Estates, and Trusts | Corporations, Partnerships, and Other Non-Individuals |

|---|---|---|

| Form 1700 | Form 1701 | Form 1702Q |

| Annual Income Tax Return (earning purely compensation income, including non-business/non-profession income) | Annual Income Tax Return (for self-employed) | Quarterly Income Tax Return |

| Form 1701A | Form 1701Q | Form 1702-EX |

| Annual Income Tax Return (earning income purely from business/profession, for those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate) | Quarterly Income Tax Return | Annual Income Tax Return (EXEMPT under the Tax Code, as amended, [Sec. 30 and those exempted in Sec. 27(C)] and other special laws, with no other taxable income) |

| Form 1702-MX | ||

| Annual Income Tax Return (with MIXED income subject to multiple income tax rates or with income subject to special/preferential rate) | ||

| Form 1702-RT | ||

| Annual Income Tax Return (subject only to regular income tax rate) |

Methods of Filing

NOTE: Gather all related documents and data from your accounting records before filing your ITR. If you are unsure of the requirements, you may check the guidelines found at the back of each tax return.

You can file your ITR using any of the following methods:

- Manual Tax Filing

- Electronic Filing and Payment System (eFPS)

- Electronic BIR Forms (eBIRForms)

Manual Filing

Requires a taxpayer to visit the nearest Authorized Agent Bank (AAB) of the RDO to declare their taxes.

Process

Step 1. Download, fill out, and print three copies of the accomplished BIR Forms.

Step 2. If you’re required to pay taxes, go to the accredited bank of the RDO where you’re registered. Present the accomplished BIR form and the required documents (check the requirements on the BIR website).

Step 3. Get your copy of the duly stamped and validated BIR form. This will be your proof that you’ve filed your ITR.

Electronic Filing and Payment System (eFPS)

Requires the taxpayer to file their returns and pay for their tax liabilities online (limited to large taxpayers, non-large taxpayers, and other taxpayers included in Revenue Regulations (RR) No. 1-2013).

Process

Step 1. Access the official eFPS website and sign up by clicking the “Login” page and then click “Enroll to eFPS”.

Step 2. Fill up the application form.

Step 3. After accomplishing the application form, click the “Submit” button.

NOTE: If the taxing agency approves your application, you may proceed to file tax returns and validate them with this system. Online banking facilities are available for eFPS taxpayers.

The BIR may reject your application if:

- Upon investigation, the taxing authority identifies you as a bogus taxpayer;

- The information you provided does not match with the data stored from the BIR database; and/or

- The President of the Corporation/ Head of Office does not authorize your application.

Electronic BIR Forms (eBIRForms)

Digital filing process for non-eFPS taxpayers and Accredited Tax Agents (ATA).

NOTE: The tax filing process is digital but the taxpayer is required to visit an AAB to pay their tax dues.

Process

Step 1. Visit the BIR website. Click “eServices”.

Step 2. Download the latest Offline eBIRForms Package.

Step 3. Access the package and select the required tax return. Fill up important details.

Step 4. After filling up the required form, save a copy of the finalized tax return.

Step 5. Submit the completed form to the Online eBIRForms system.

Step 6. The BIR will send an email to confirm receipt of your ITR.

Step 7. Visit the nearest AAB of your RDO to pay your tax dues.

Deadline of Submission

Taxpayers must file their annual ITRs on or before April 15 following the close of each taxable year. However, some ITRs have different deadlines under the provisions of the National Internal Revenue Code (NIRC) of 1997.