BIR Further Extends the Deadline on Filing of VAT Refund Claims in the Philippines

The Bureau of Internal Revenue (BIR) released Revenue Regulations (RR) No. 16-2020 to further extend the deadline of application for Value-Added Tax (VAT) refund claims. Due to the adjustments on business processes caused by the COVID-19 pandemic, BIR extends the VAT filing for thirty (30) days from the lifting of the quarantine period. The regulations also suspend the application of the ninety (90) days processing period for VAT refund/claims for taxable quarters hit by the declaration of the national state of emergency.

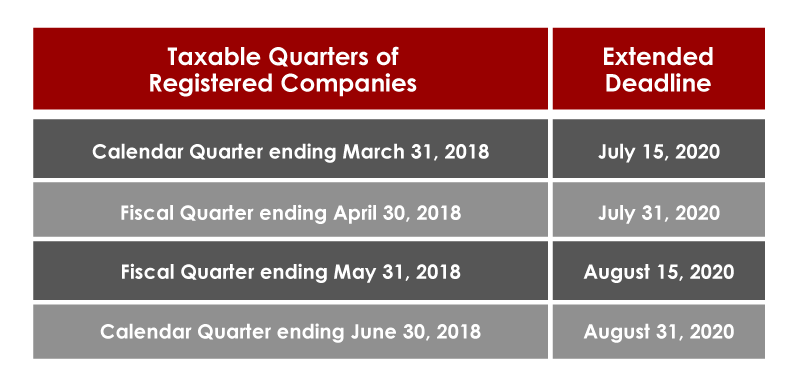

DUE DATES FOR FILING OF VAT REFUND CLAIMS

Taxpayer-claimants shall file their respective VAT refund claims in accordance with the following deadlines:

APPLICATION OF DEADLINES

The due dates indicated in this circular shall apply to areas declared to be under the General Community Quarantine (GCQ).

Areas that are still under the Enhanced Community Quarantine (ECQ) and Modified Enhanced Community Quarantine (MECQ) shall file their VAT refund claims following the given deadlines above or thirty (30) days prior to the lifting of ECQ/MECQ, whichever comes later.

PROCESSING OF VAT REFUND

The 90-day period for processing of VAT refund/claims shall be suspended in areas that are currently under ECQ and MECQ.