BIR Allows Taxpayers to Submit ITR Attachments Via eAFS System

The Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular (RMC) No. 82-2020 advising taxpayers of the availability of the electronic Audit Financial Statements (eAFS) System for the submission of attachments to their 2019 filed Income Tax Returns (ITRs).

PROCEDURES REQUIRED UPON USE OF THE EAFS SYSTEM

The following procedures shall be observed by taxpayers, whether or not registered under the Large TaxpayersService (LTS), upon using the eAFS System together with scanned copies of the required documents:

A. Taxpayers submitting ITR attachments following the FY accounting period shall observe three (3) categories, as indicated under RMC No. 49-2020, for each group of scanned documents for manually and electronically filed documents. Naming convention of the files shall observe the following formats:

File 1 – ITR: EAFSXXXXXXXXXITRTYMMYYYY

File 2 – AFS: EAFSXXXXXXXXXAFSTYMMYYYY

File 3 – Other Attachments: EAFSXXXXXXXXXOTHTYMMYYYY-01

LEGEND

XXXXXXXXX – 9-digit TIN

TY – Taxable Year as identifier for annual submission (regardless if FY or Calendar Year [CY])

MM – Month end of the TY

YYYY – Year ended

01 – First file of the attachments (up to 99)

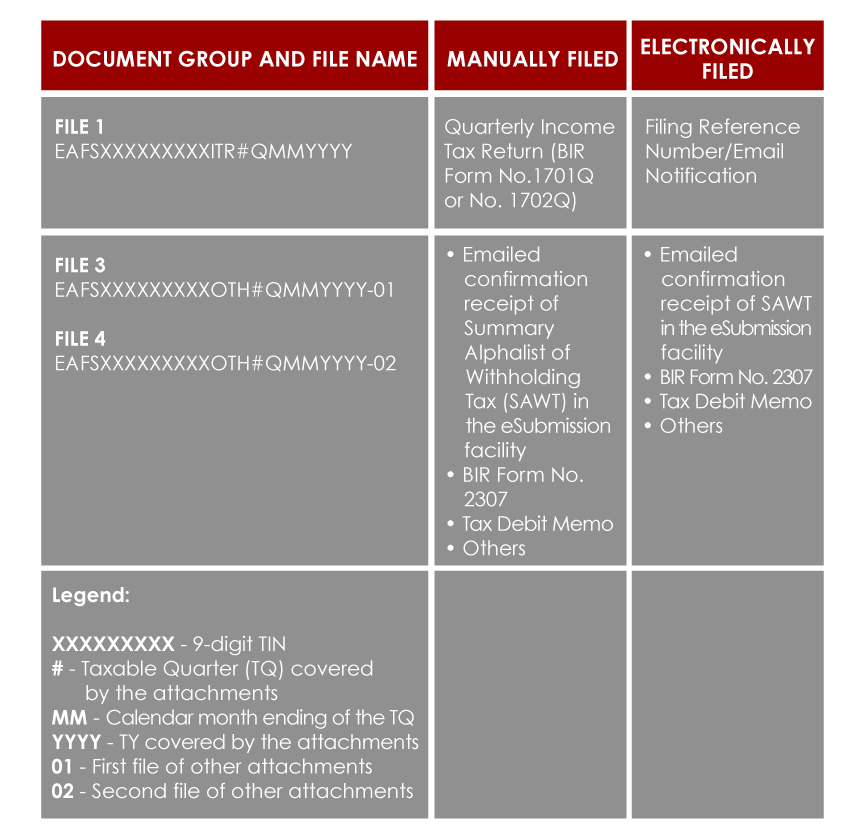

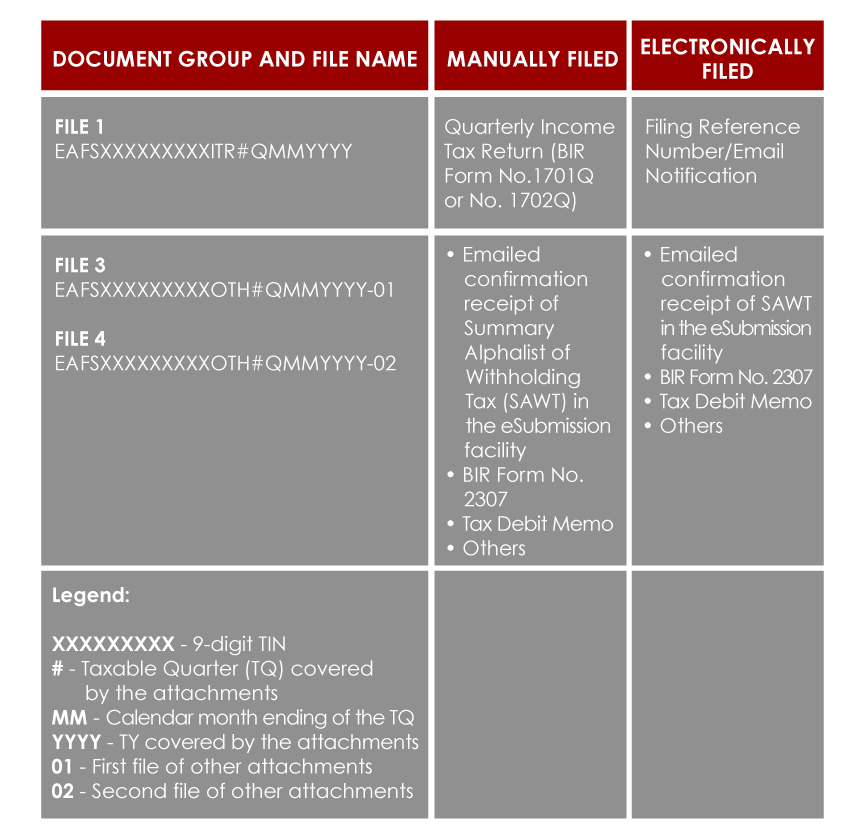

B. Documents, for the submissions of quarterly ITR attachments, shall be scanned and classified according to their corresponding naming conventions observing the following formats:

Original copies of documents that were submitted digitally shall be kept as prescribed under Revenue Regulations (RR) No. 17-2013.

Thank you, TRISHA.

Your process is most updated.