Manage the Accounting of Your E-Commerce Business Effectively

With a large pool of experienced consultants, AHC can provide you with useful tools and methods to ensure that your accounting process is accurate and secure.

With a large pool of experienced consultants, AHC can provide you with useful tools and methods to ensure that your accounting process is accurate and secure.

Trisha Alexis Maingat is a Digital Marketing Specialist juggling ideas to produce concepts for digital and social media campaigns across various online channels. Aside from creative copies, Trish loves to write and contribute articles on topics such as labor and tax advisories, government updates, and business in the Philippines.

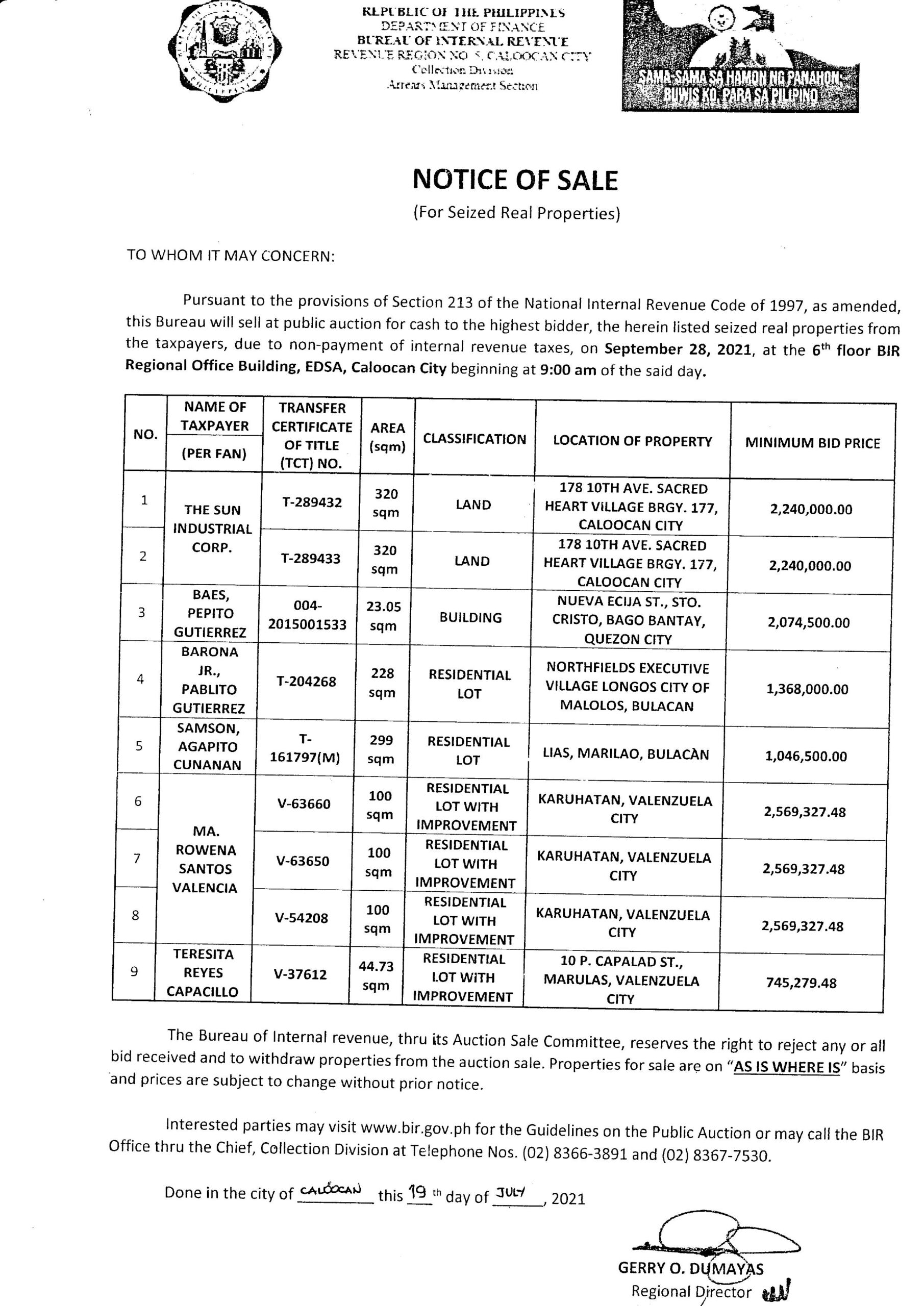

View all postsThe Bureau of Internal Revenue (BIR) releases Revenue Regulations (RR) No. 10-2020, pursuant to section 4(z) of the Republic Act No. 11469, otherwise known as “Bayanihan to Heal as One Act”, amending Section 2 of the RR No. 7-2020 further extending the deadlines for submission, filing, and payment of significant documents and/or taxes due to prolonged implementation of the Enhanced Community Quarantine (ECQ) until April 30, 2020.

The Bureau of Internal Revenue (BIR) proposes Revenue Regulations to implement certain sections of the NIRC of 1997 (Tax Code), as Amended.

BIR suspends the running of the statute of limitations on assessment and collection of taxes pursuant to Section 223 of the NIRC of 1997, as amended, due to the declaration of ECQ and MECQ in the National Capital Region and other areas of the country.

BIR extends the deadline for the filing of applications and suspends the 90-day processing of VAT refund claims with the VAT Credit Audit Division.

Author Trisha Alexis Maingat Trisha Alexis Maingat is a Digital Marketing Specialist juggling ideas to produce concepts for digital and…

Annually, the Philippines conducts its tax rounds for businesses nationwide. Let’s take a deeper look into the Philippine Business Tax System.

The Bureau of Internal Revenue (BIR), in an advisory published on April 28, released the deadlines for the filing of amended Annual Income Tax Returns (AITRs) and required attachments in the electronically-filed AITR of the taxable period ending on December 31, 2020. The Bureau strictly reminds taxpayers the due dates for filing to avoid penalties.

BIR provides the guidelines in the filing of returns and payment of corresponding taxes due thereon, and submission of reports and attachments falling within the period from August 6 to 20, 2021 for taxpayers under ECQ and MECQ.

As instructed by the Department of Finance (DOF), the Bureau of Internal Revenue (BIR) is currently exploring methods to properly tax activities under the digital economy and enhance revenue collections by closing tax leakages.

The Bureau of Internal Revenue (BIR) releases Revenue Memorandum Circular (RMC) No. 36-2020, pursuant to Revenue Regulations (RR) No. 8-2020 and RMC No. 35-2020, clarifying the exemption from Documentary Stamp Tax (DST) as a relief for payers of qualified loans.

The Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular (RMC) No. 97-2020 establishing a standard policy/guidelines on the use of BIR Form No. 0605. The said form shall now be authorized for use on certain transactions only to avoid challenges in monitoring and reconciling the record of taxpayers.

The Bureau of Internal Revenue (BIR) instructed Philippine Offshore Gaming Operators (POGO) to remit their monthly withholding taxes on or before August 10, 2019. Under the mandated modes of filing and payment, employers have to remit withholding taxes from their employees on the 10th day after the end of the previous month.

BIR creates the Alphanumeric Tax Code (ATC) for Excise Taxes on Exports of Sweetened Beverages Products paid through Payment Form – BIR Form No. 0605.

The Bureau of Internal Revenue (BIR) reminds all political bets and parties of the 2019 midterm elections to submit their Statement of Contributions and Expenditures (SOCE) to the Commission on Elections (COMELEC) and their Revenue District Office (RDO) on or before June 13.

The Bureau of Internal Revenue (BIR) released a tax advisory, issued on March 30, clarifying the amount of tax payments relative to the eFPS facility — a BIR online system for computation of penalties.